Stop Losing Customers to Bad Payment Processes

Most payment failures aren’t real declines — they’re routing problems, issuer mismatches, or outdated credentials. Sticky.io Payment Orchestration intelligently routes, retries, and recovers transactions in real time, so more payments go through and more revenue keeps flowing.

160+ Payment Gateways

One Payments Engine. Endless Paths to Approval.

Sticky.io replaces single-path payment processing with intelligent orchestration. You connect multiple gateways, MIDs, and providers once — then let our platform automatically find the best path for every transaction.

Route Transactions to the Best-performing Gateway

Not all gateways perform equally across issuers, geographies, or card types. Sticky.io dynamically routes transactions based on real performance data, issuer response, and business rules — maximizing approvals while minimizing unnecessary retries and fees.

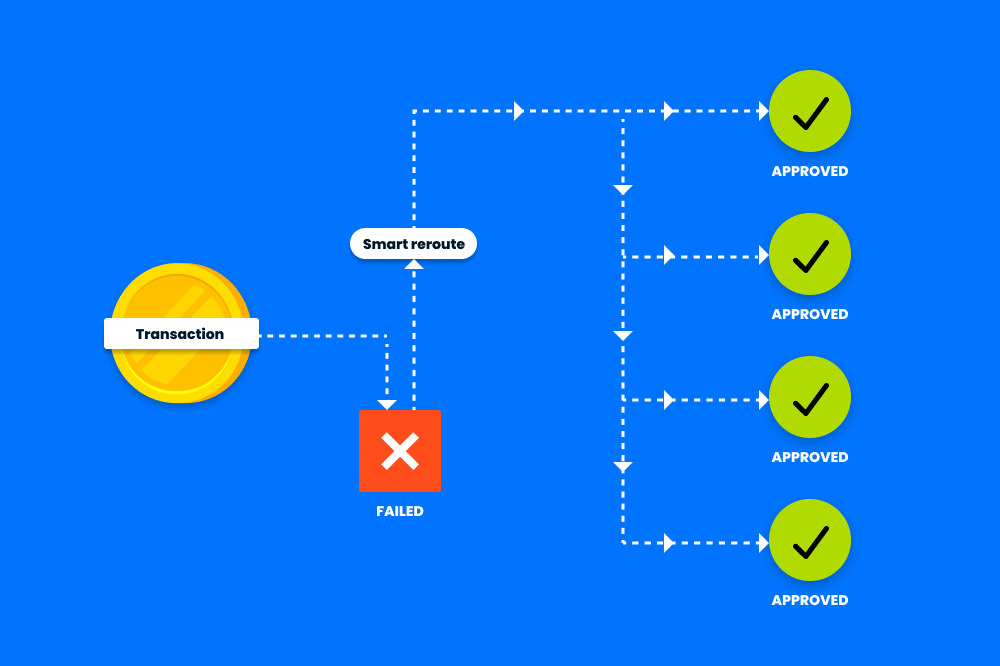

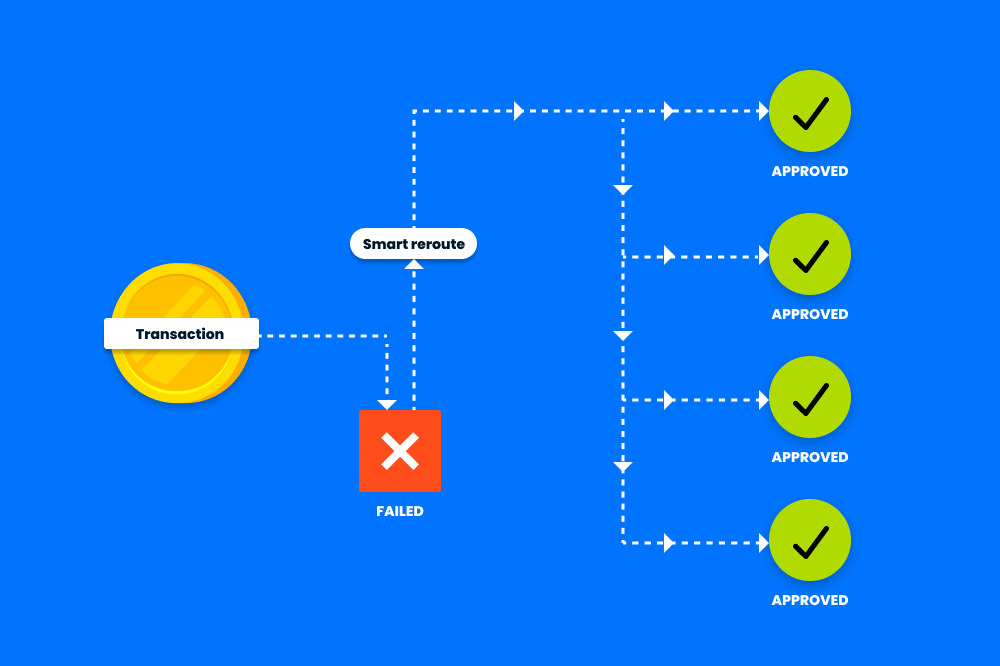

Recover False Declines Instantly with Intelligent Cascading

If a transaction fails, Sticky.io doesn’t stop there. Cascading logic automatically retries through alternative gateways or MIDs — often converting a decline into an approval in milliseconds, without disrupting the customer experience.

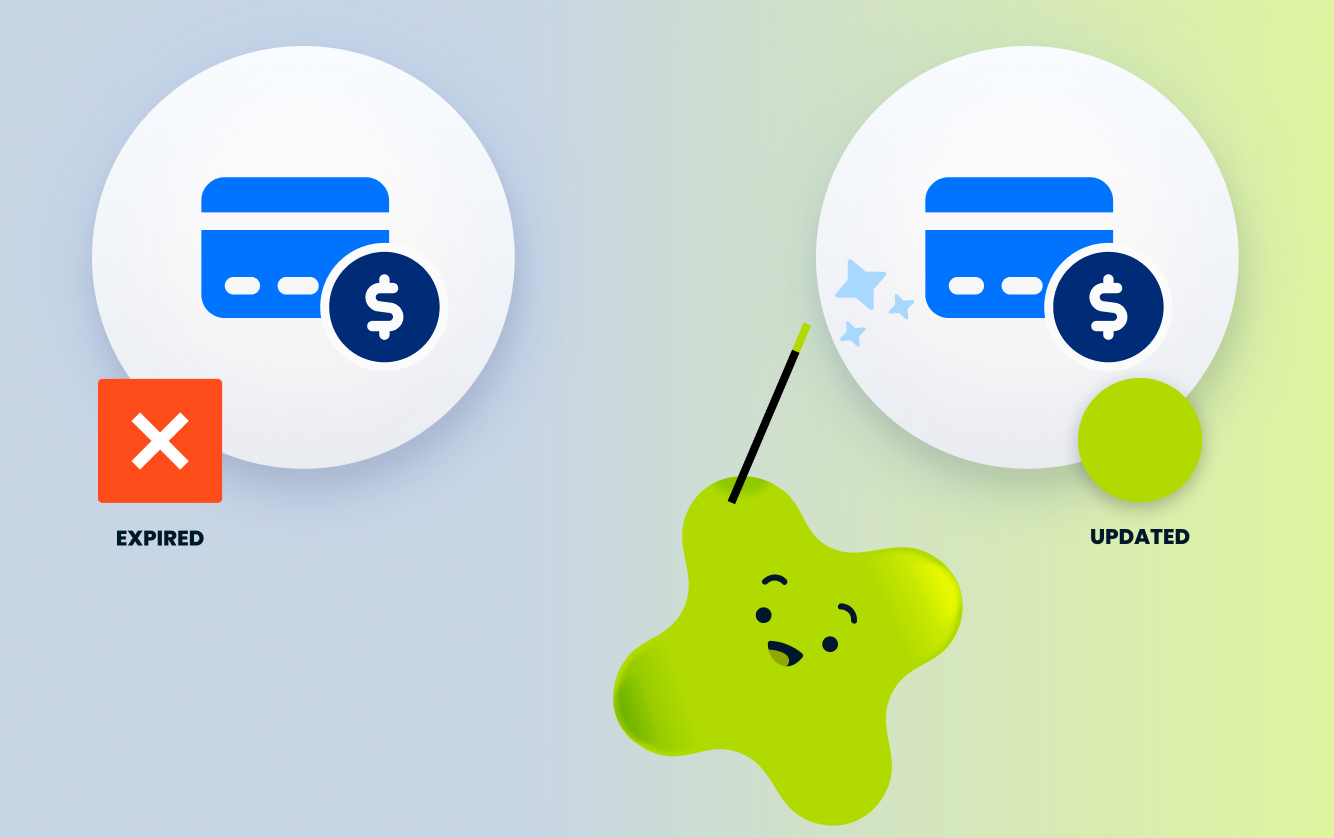

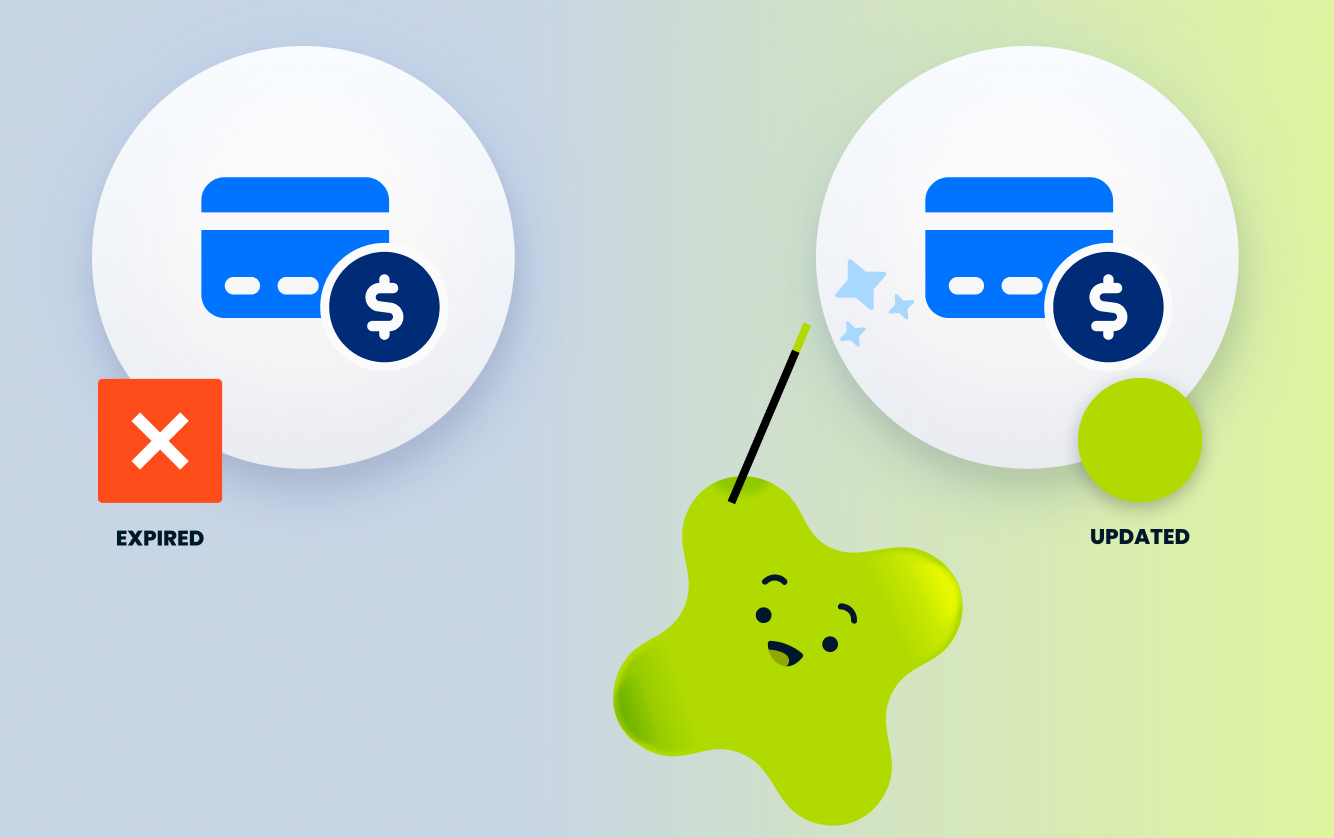

Keep Payment Credentials up to Date Automatically

Expired cards and outdated account details are a leading cause of involuntary churn. Built-in account updater services refresh customer credentials automatically—saving renewals that would otherwise fail silently.

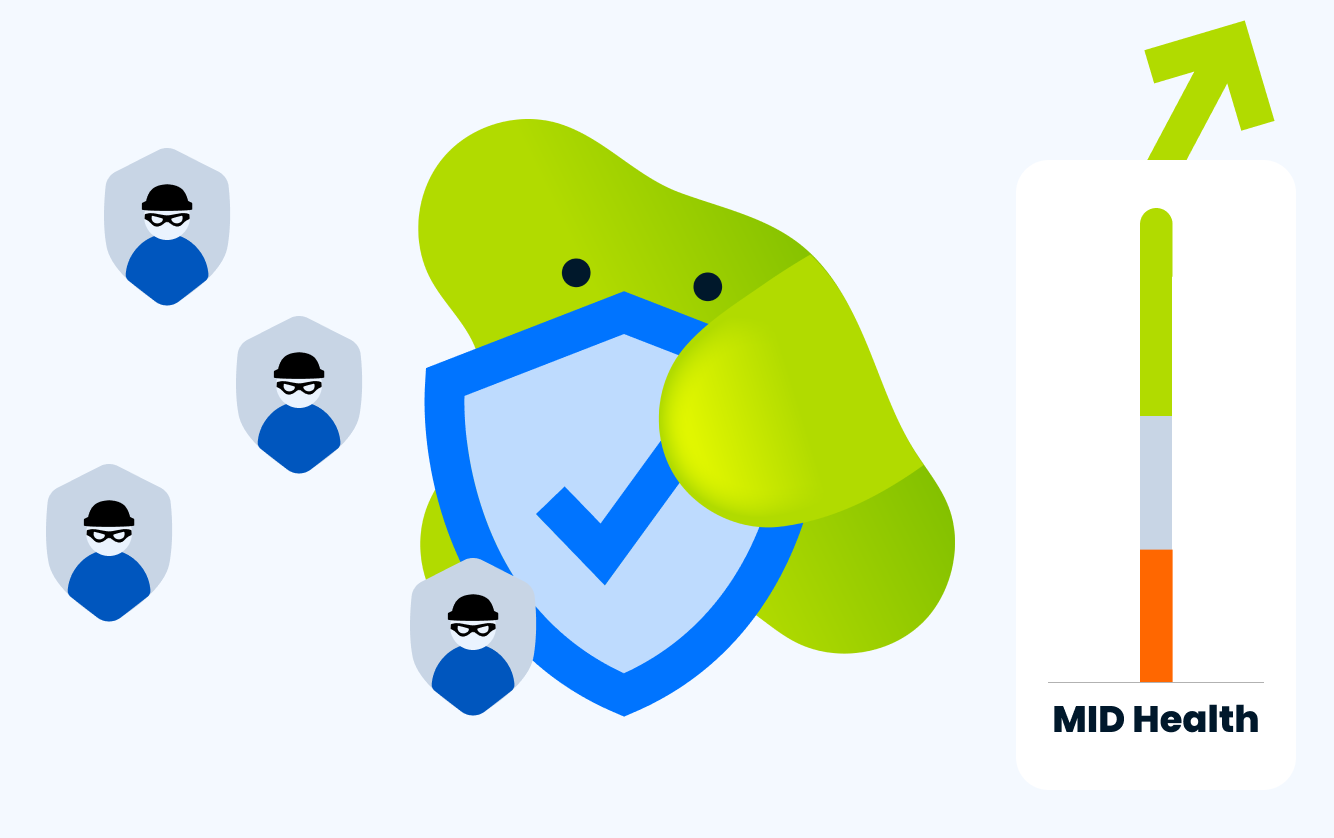

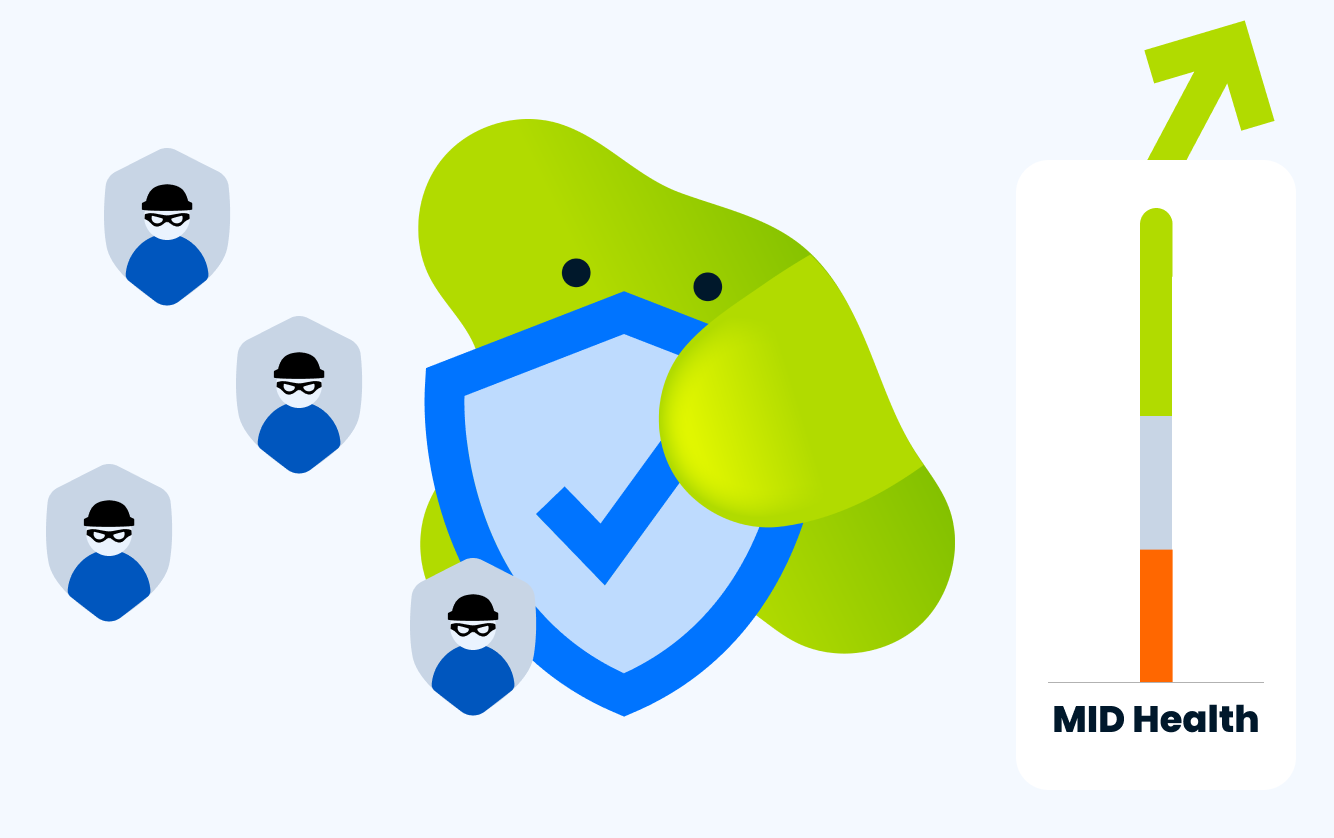

Distribute Risk. Defend MID Health. Stop Fraud Early.

Payment orchestration isn’t just about approvals — it’s about longevity. Sticky.io helps distribute volume across MIDs, reduce chargeback concentration, and proactively block risky transactions using BIN-level and behavior-based controls.

Transactions route dynamically based on issuer, card type, geography, and real approval data.

When a payment fails, Sticky retries intelligently—without customer friction.

Expired cards update automatically before billing attempts.

Block high-risk BINs and suspicious behavior before fraud happens.

Distribute volume and chargebacks to protect processing relationships.

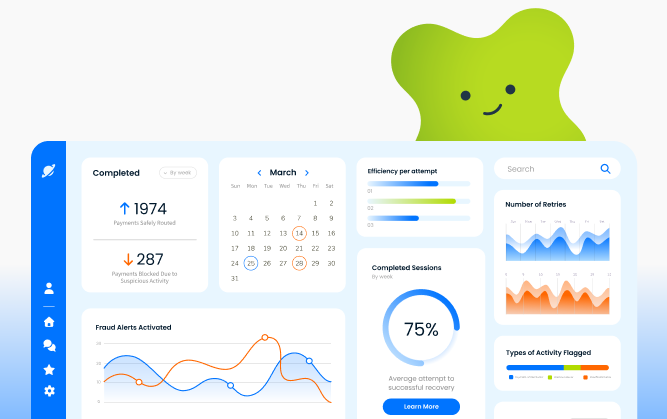

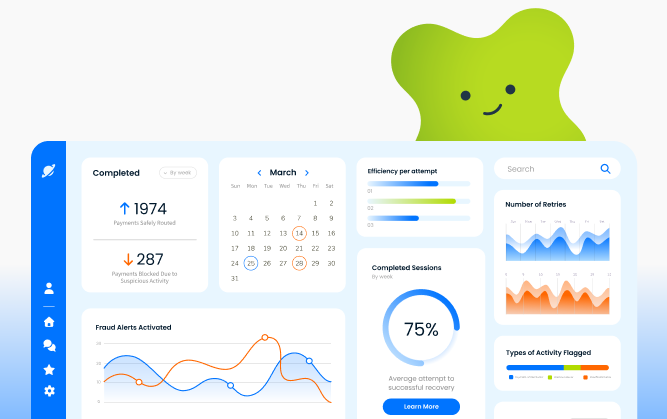

See approvals, declines, and performance across gateways in one dashboard.

Smart Routing

Transactions route dynamically based on issuer, card type, geography, and real approval data.

Cascading Logic

When a payment fails, Sticky retries intelligently—without customer friction.

Account Updater

Expired cards update automatically before billing attempts.

Fraud Controls

Block high-risk BINs and suspicious behavior before fraud happens.

MID Health Monitoring

Distribute volume and chargebacks to protect processing relationships.

Real-Time Insights

See approvals, declines, and performance across gateways in one dashboard.

Still Relying on a Single Payment Path?

Proven Churn Reduction at Scale

From higher approval rates to millions in recovered revenue, see how Sticky.io helps brands reduce involuntary churn across complex subscription businesses.

Truly Free Found a Better Way— and Bigger Wins

Sticky.io has given us the ability to take our company and our membership experience to a whole new level. If you’re in the ecommerce world and thinking about subscribing your tribe and giving them a world-class experience, as well as getting scalable insights to how you can grow your company — I really don’t know of another platform I would recommend like Sticky.io.

How SkinnyFit Built Smarter Subscriptions

Partnering with Sticky.io has given us the ability to quickly change and pivot based on what bests resonates with our customers. We’re able to understand our customers on a deeper level and provide more value.

How Flexible Funnels Fueled Floral Commerce Growth

Since we’ve launched subscriptions, it has become a more and more important part of our offering each year as we grow it and as it helps us have that more expected revenue coming in, which is helpful for our farms and our other partners.

How RealDefense Simplified Complex Billing at Scale

If you’re looking for a billing platform that will work with you to solve your business needs, Sticky.io is it.

FAQs: Payment Orchestration & Smart Routing

What is payment orchestration?

How does payment orchestration improve authorization rates?

What is payment routing and how does it work?

What is payment cascading and initial dunning?

How does payment orchestration reduce failed payments and false declines?

Can payment orchestration help reduce subscription churn?

Is payment orchestration only for enterprise or high-risk merchants?

Does payment orchestration slow down checkout or add friction?

How does payment orchestration help protect MID health?

What’s the difference between a payment gateway and a payment orchestrator?

Can payment orchestration integrate with my existing ecommerce stack?

When should a business consider using payment orchestration?

Stop Losing Revenue to Bad Payment Processing

Stop relying on a single gateway or static routing rules. See how intelligent orchestration, cascading, and issuer-aware logic can increase approvals, protect your MIDs, and keep revenue flowing at scale.