Friendly Fraud & The Chargeback Challenge: How to Overcome It

Launch offers fast and keep customers longer.

Convert more traffic without adding friction.

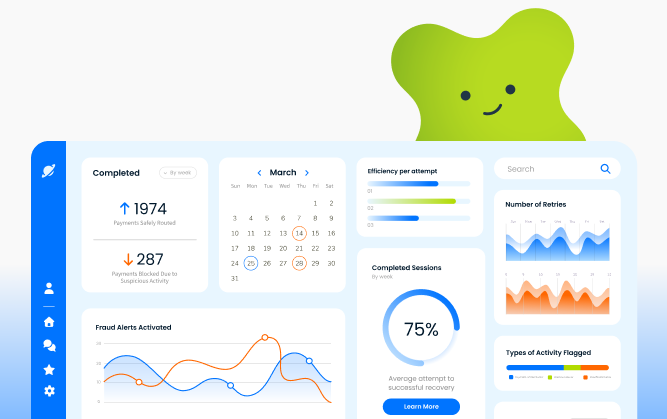

Recover up to 75% of declined transactions.

Increase approvals across every gateway.

Unlock new growth opportunities through our trusted partners.

500+ integrations with systems your team already loves.

See what’s possible for your growth goals.

Understand what’s shaping your growth.

Find practical ways to scale smarter.

Let's talk revenue at an upcoming event!

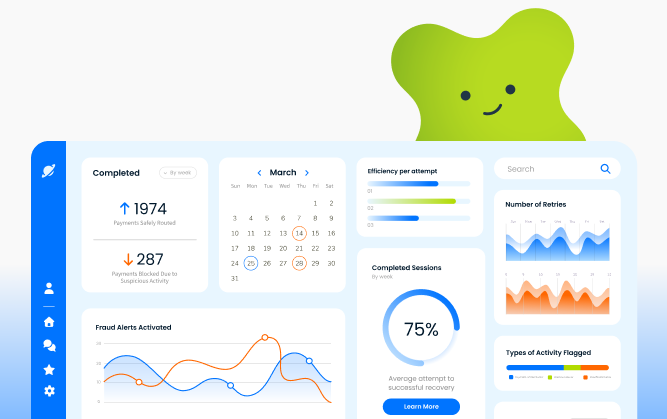

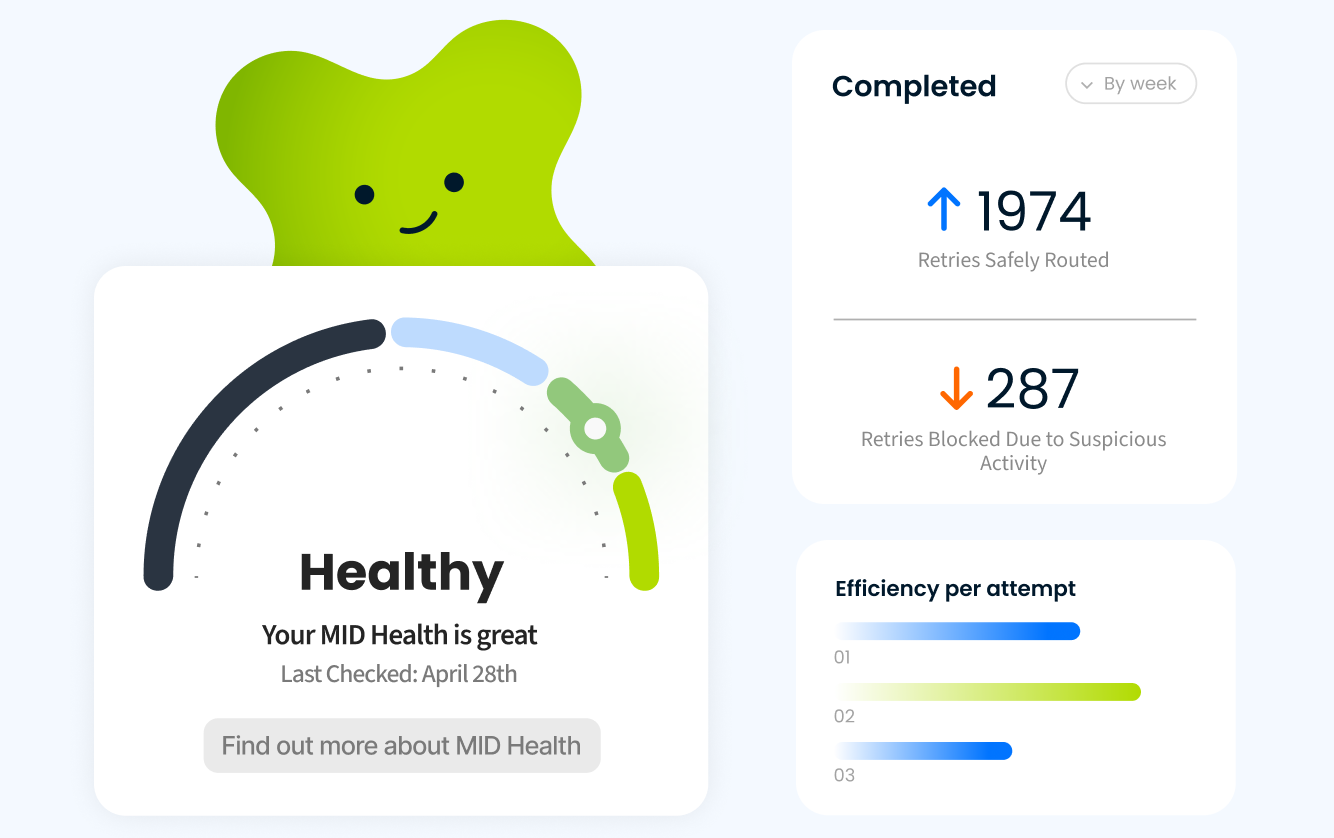

Most failed payments happen by accident. Sticky.io Recovery turns declines into approvals with smart retries and intelligent routing, helping you recover up to 75% of lost revenue and keep subscribers longer.

Retry Engine

Smart Routing

Subscriptions Saved

Failed payments quietly drain recurring revenue long before customers realize there’s a problem. Sticky.io catches issues in real time, re-routes failing transactions, and keeps subscribers active automatically.

Sticky.io analyzes decline reasons, issuer signals, and historical behavior to time each retry for the highest chance of approval. No guesswork — just recovered revenue.

See it in Action

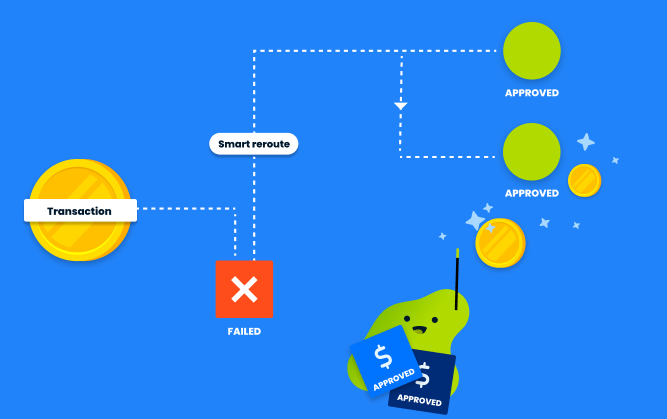

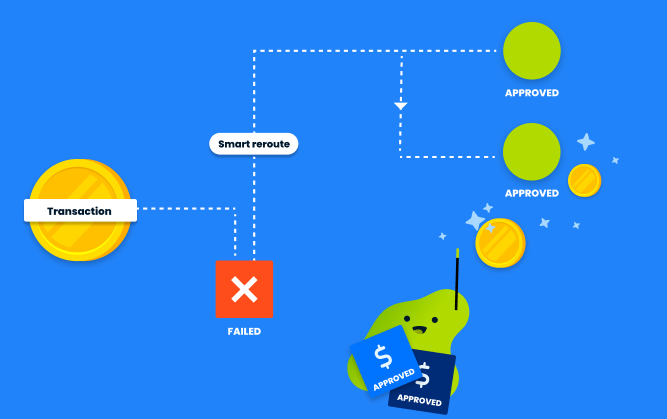

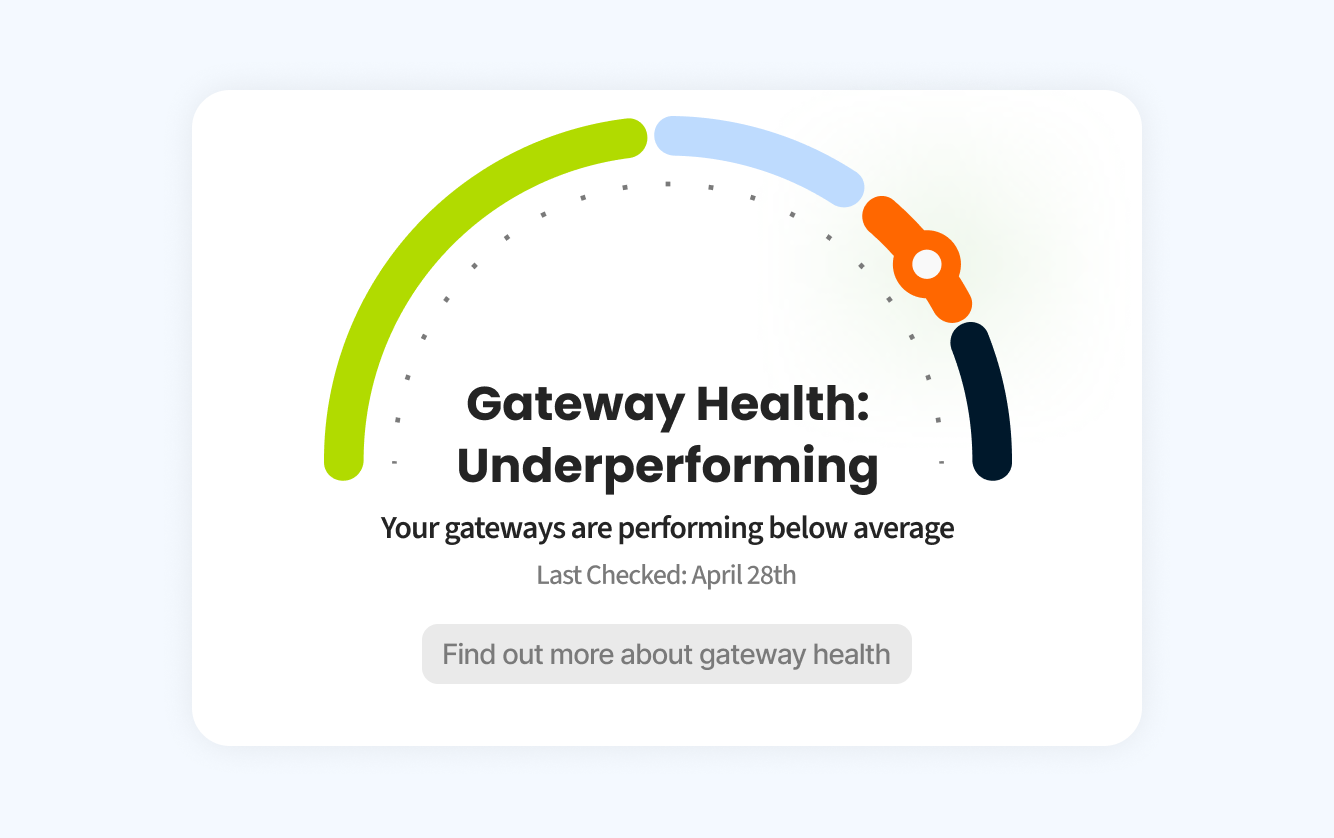

If the first attempt fails, routing logic instantly selects a better-performing gateway — preventing declines and capturing more first-time approvals.

Improve My Approval Rates

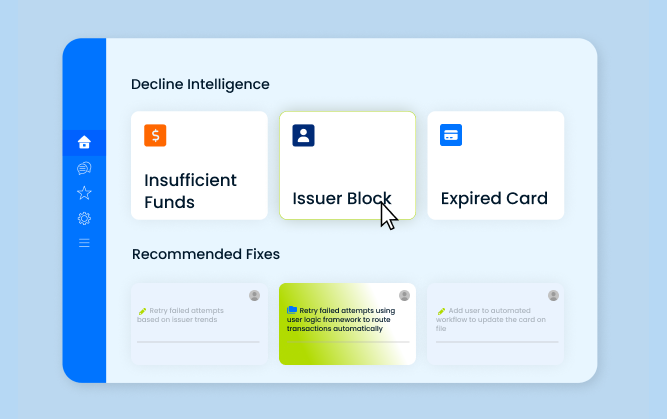

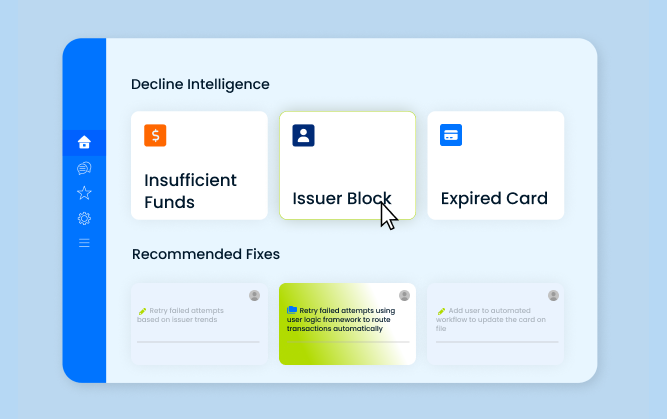

Get full visibility into why payments fail with live decline codes, issuer insights, and risk indicators — so your team solves issues before they become revenue loss.

Experiene Decline Intelligence

Protect renewal flows with automated fraud detection, chargeback monitoring, and VAMP-aware controls that keep merchant accounts healthy.

Reduce Risk

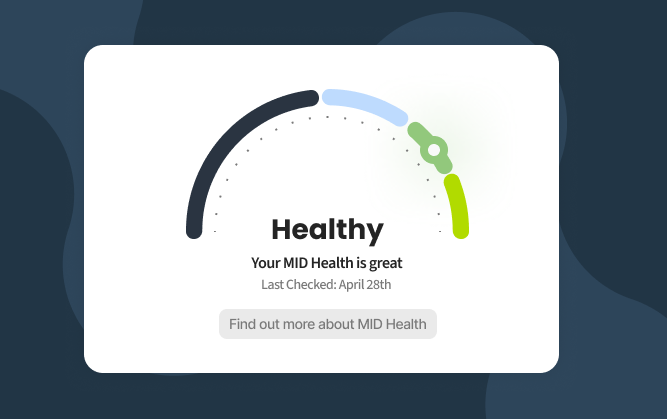

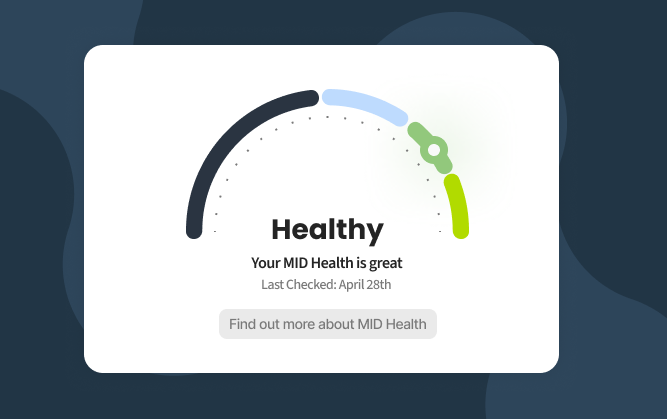

Sticky.io helps maintain MID stability with safe processing patterns, dispute prevention, and compliance-friendly retry sequences that keep processors confident in your business.

Strengthen Merchant Health

Sticky.io analyzes decline reasons, issuer signals, and historical behavior to time each retry for the highest chance of approval. No guesswork — just recovered revenue.

See it in Action

If the first attempt fails, routing logic instantly selects a better-performing gateway — preventing declines and capturing more first-time approvals.

Improve My Approval Rates

Get full visibility into why payments fail with live decline codes, issuer insights, and risk indicators — so your team solves issues before they become revenue loss.

Experiene Decline Intelligence

Protect renewal flows with automated fraud detection, chargeback monitoring, and VAMP-aware controls that keep merchant accounts healthy.

Reduce Risk

Sticky.io helps maintain MID stability with safe processing patterns, dispute prevention, and compliance-friendly retry sequences that keep processors confident in your business.

Strengthen Merchant HealthMost silent churn isn’t intentional — it’s caused by failed payments. Sticky.io plugs the leaks across retries, routing, fraud, and renewal intelligence so revenue stops disappearing.

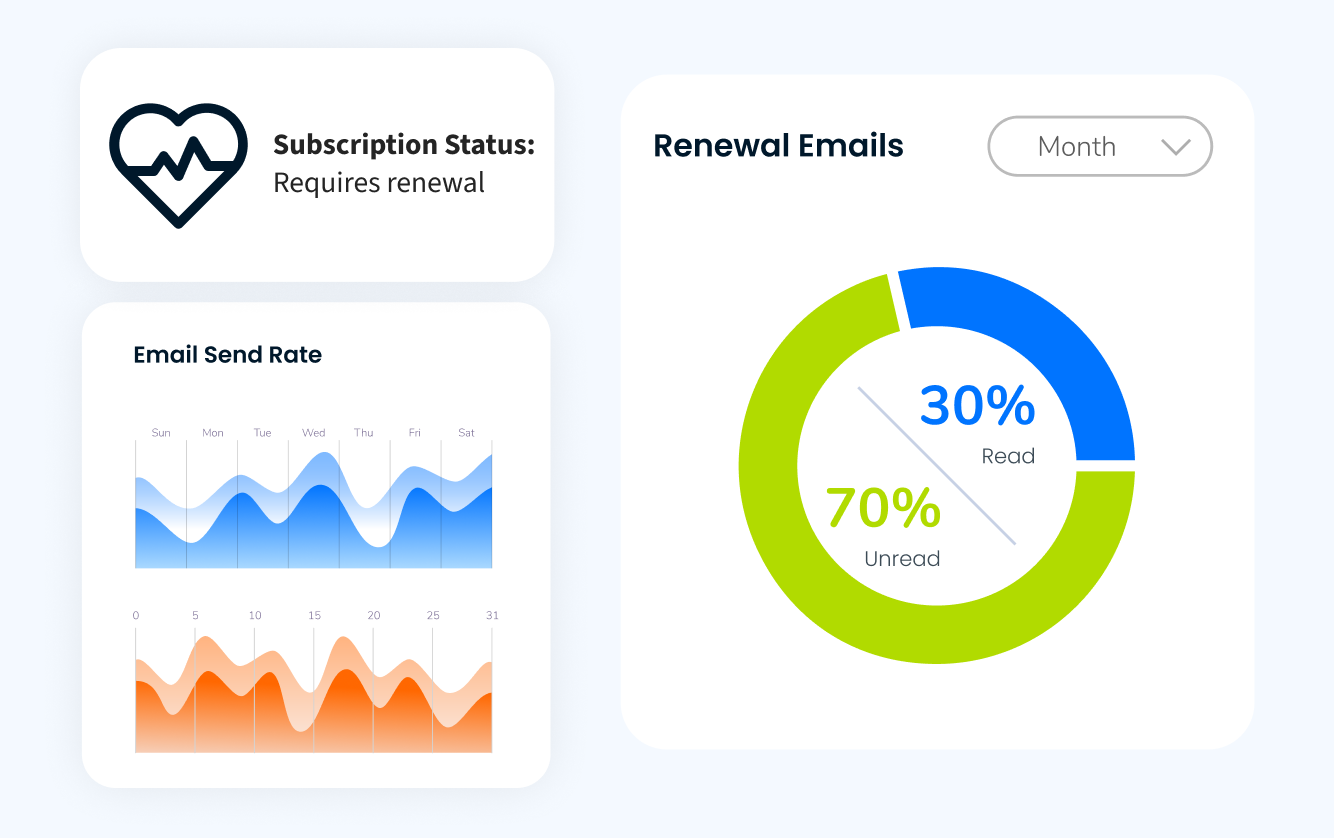

Subscribers often churn without realizing their payment failed. Most systems don’t alert merchants until it’s too late.

Even top gateways fluctuate. Without routing, approval rates drop and renewals fail unnecessarily.

Customers rarely read renewal emails, and even when they do, emails can’t solve issuer logic, fraud flags, or gateway outages. Modern failed payment recovery has to operate at the payment level, not the inbox.

Smart retries and rerouting recover payments silently in the background — keeping subscribers active without messaging them.

Routing and retry intelligence improves approval rates instantly, capturing revenue traditional systems never reach.

Safe retry pacing and fraud checks stabilize MID health, preventing costly processor interventions.

Understand the infrastructure constraints behind renewals. Learn how gateway behavior, decline strategies, and retry pacing affect the stability of your merchant accounts.

See exactly how much more recurring revenue you could capture with intelligent retries and routing. This article removes guesswork and quantifies real recovery upside.

Sticky.io powers every renewal with smart retry timing, intelligent routing, and protection that strengthens revenue long before churn appears.

AI-powered retry logic selects the best approval window for every decline, recovering more payments with fewer attempts.

Sticky.io automatically finds the strongest-performing gateway for each transaction, eliminating single-path failures.

See the real reasons behind failed payments so you can fix issues early and prevent repeated declines.

Fraud detection and MID-aware rules keep your renewal flow safe from risky behavior.

Protect your subscriber base by reducing involuntary churn and keeping renewals stable month over month.

Every recovered payment strengthens your revenue engine and boosts predictable growth.

See how subscription and ecommerce teams use Sticky.io’s connected platform to reduce friction, increase customer value, and protect the revenue they work hard to earn.

Sticky.io has given us the ability to take our company and our membership experience to a whole new level. If you’re in the ecommerce world and thinking about subscribing your tribe and giving them a world-class experience, as well as getting scalable insights to how you can grow your company — I really don’t know of another platform I would recommend like Sticky.io.

Partnering with Sticky.io has given us the ability to quickly change and pivot based on what bests resonates with our customers. We’re able to understand our customers on a deeper level and provide more value.

Since we’ve launched subscriptions, it has become a more and more important part of our offering each year as we grow it and as it helps us have that more expected revenue coming in, which is helpful for our farms and our other partners.

If you’re looking for a billing platform that will work with you to solve your business needs, Sticky.io is it.

Declines don’t happen randomly. With multi-gateway routing, intelligent failover, and issuer-aware logic, Sticky.io ensures every renewal takes the path with the highest chance of approval — powering stronger recovery outcomes across your entire business.

From acquisition tools to payment processors, Sticky.io brings every part of your revenue stack into a unified flow. Recovery becomes more accurate, approvals increase, and merchant health stays protected through seamless platform communication.

Most systems still rely on reminder emails and scheduled retries, a process built for a much simpler payments landscape. Sticky.io uses real payment intelligence to understand why a transaction failed and applies routing, timing, and fraud logic to recover revenue traditional dunning can’t reach.

Traditional dunning retries payments at fixed intervals, ignoring decline codes, issuer rules, and customer behavior — resulting in preventable failures.

Most systems send every payment through one gateway. If it fails, revenue stops. Intelligent routing instantly finds the best-performing path to approval.

Legacy dunning overlooks fraud patterns, issuer blocks, and merchant-health risk — creating chargebacks and unstable processing. Modern recovery protects your MIDs with real-time intelligence.

Video

Video

"Traditional dunning relies on fixed schedules and guesswork. Sticky.io Recovery uses AI-powered retry logic, intelligent payment routing, and real-time decline intelligence to maximize approval rates for every failed payment.

Instead of retrying transactions at predetermined intervals, Recovery analyzes issuer behavior, decline codes, gateway performance, and historical patterns to determine the exact moment and path most likely to succeed.

It also integrates easily through API and works with any ecommerce platform, payment stack, or subscription system, making it a modern recovery engine — not just a dunning tool. In short, Sticky.io Recovery is modern failed payment recovery software designed to reduce involuntary churn at scale."

You can, but it’s not ideal. Running traditional dunning alongside Sticky.io often leads to redundant retries, unnecessary processor fees, and lower approval rates, because legacy systems don’t use issuer intelligence or adaptive timing.

Sticky.io Recovery performs best when it manages all failed payment recovery across your subscription base. With AI-driven retry timing and multi-gateway routing, merchants typically see far higher recovery rates on the first or second attempt alone.

Sticky.io maintains PCI DSS Level 1 compliance, the highest standard for payment security. Every transaction, retry, and recovery event is processed through secure, compliant infrastructure designed to protect sensitive customer data from start to finish.

Sticky.io’s AI is built to be customer-sensitive and brand-safe. It evaluates decline reasons, issuer preferences, and customer behavior to choose retry windows that maximize approvals without creating customer friction.

You also control how many attempts are made and how recovery aligns with your customer communication strategy — ensuring your retry logic feels seamless, not aggressive.

Not at all. Recovery integrates through a streamlined API and typically takes two to three days to go live. Once enabled, it becomes a fully automated, zero-maintenance solution, recovering failed payments in the background while your team focuses on growth.

Recovering failed payments has a direct, compounding effect on CLTV. Sticky.io helps subscription brands reduce involuntary churn, rescue renewals, and improve first-attempt approvals, which leads to more billing cycles per customer.

Brands using Recovery commonly retain customers 3.5× longer and stabilize recurring revenue, creating predictable long-term value.

Virtually none. Sticky.io Recovery is hands-off. After a quick setup, the system autonomously determines the best retry timing, routing, and recovery path for each transaction — with no manual workflows required.

Your team gets full visibility, but Recovery does the work.