Protect Every Renewal.

Maximize Every Dollar.

Your best customers shouldn’t be lost to preventable payment failures. Sticky.io gives subscription businesses a smarter way to safeguard recurring revenue — with AI-powered retries, smart dunning, intelligent routing, fraud prevention, and real-time insights that dramatically reduce involuntary churn.

Recover the Revenue Most Platforms Miss

Recurring revenue shouldn’t disappear after the first decline. Sticky.io uses AI-powered retry logic and intelligent routing to recover failed rebills automatically — turning silent churn into predictable growth.

AI-Powered Retry Logic

Smart Routing & Cascading

Decline Reason Analytics

Your Billing System Bills Customers — But It Doesn’t Protect Them

Many subscription losses happen invisibly at renewal — not because customers want to leave, but because their payment fails. Sticky.io adds the intelligence layer your billing platform wasn’t built for: adaptive retries, smart routing, and fraud controls that keep subscribers active.

Our retry engine adapts to issuer rules, decline codes, and global timing patterns — recovering failed renewals your billing system misses. No noise, no over-retrying, no additional work.

Unlock Smart Retries

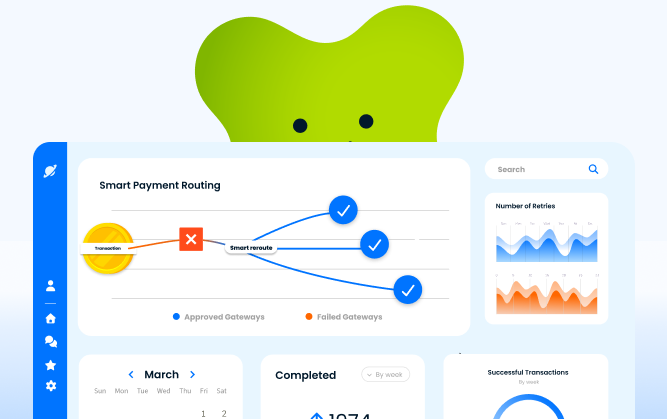

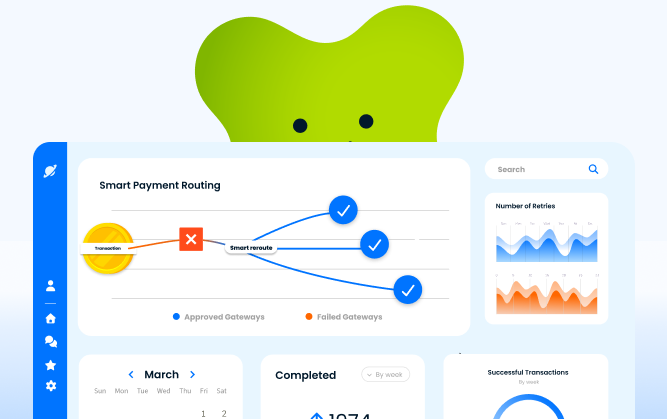

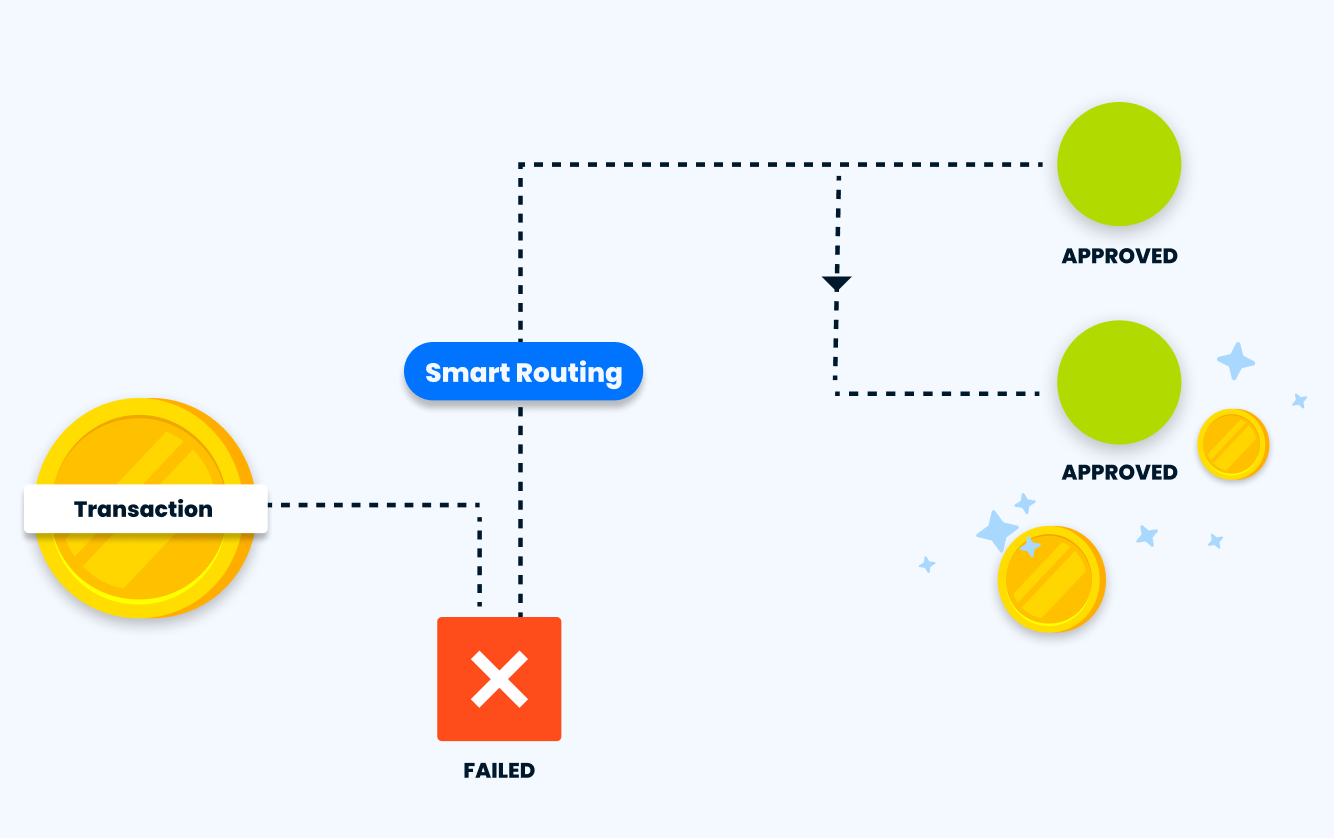

When a transaction fails, we automatically route it to the gateway or MID most likely to succeed — increasing approvals and protecting predictable revenue.

Explore Smart Routing

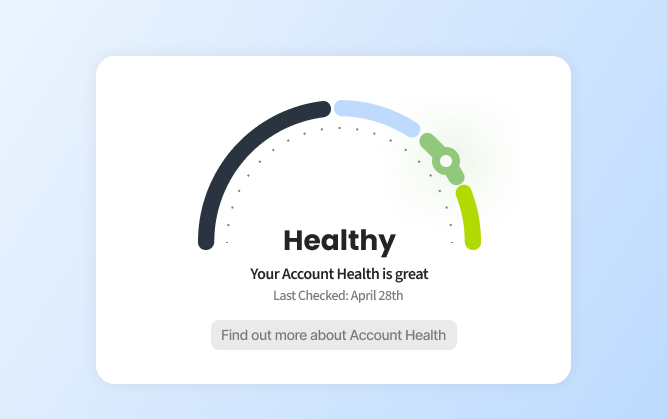

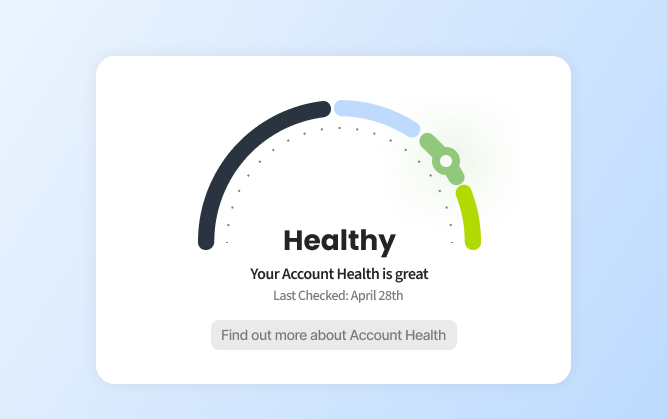

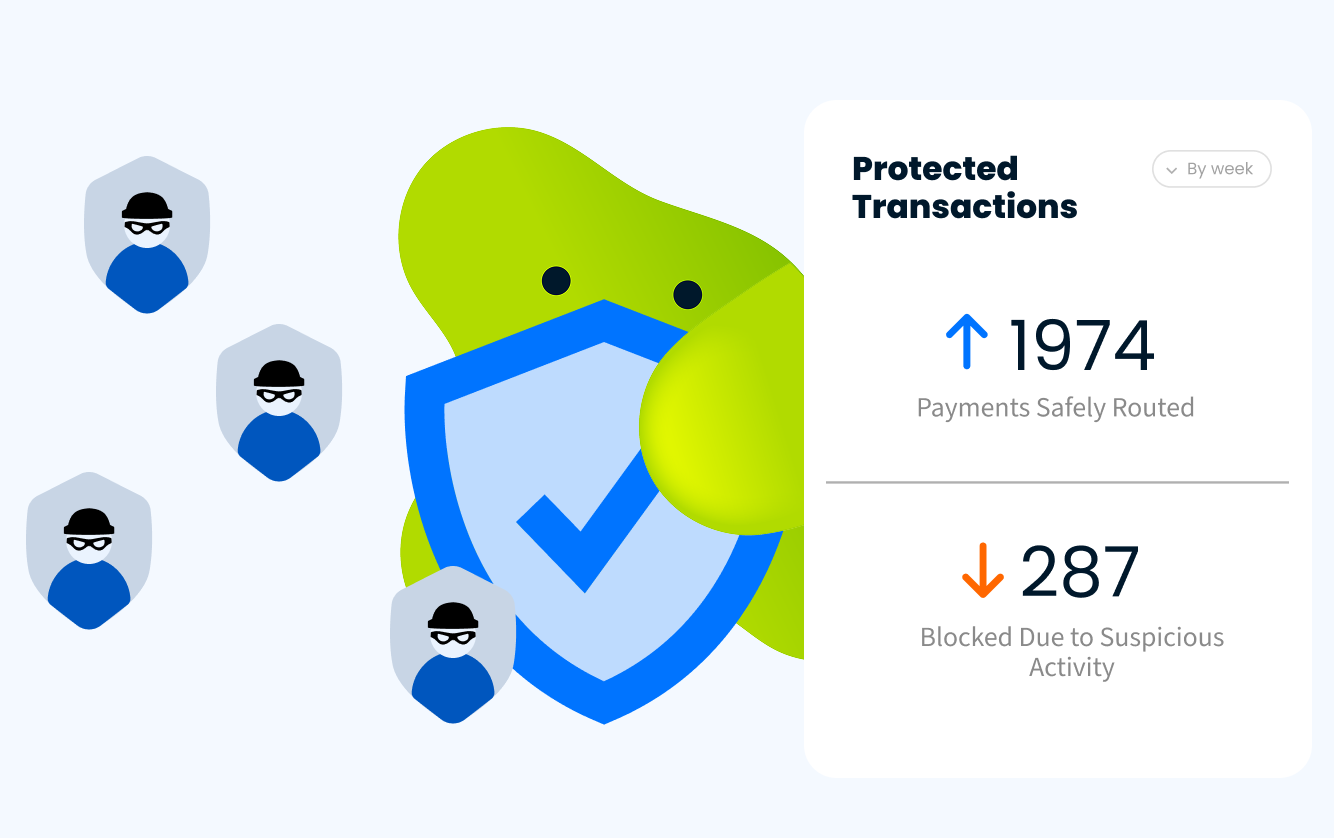

Behavioral scoring, velocity checks, device intelligence, 3DS orchestration, and chargeback alerts reduce risk before it impacts your MID health.

Protect Account Health

See exactly where you’re losing money — and where you’re recovering it — with dashboards built for finance teams, treasury leaders, and payment operators.

Get Better Reporting

Whether you use a popular billing platform or a custom solution, Sticky.io adds the missing intelligence layer that improves renewals without disrupting operations.

See All IntegrationsSmarter Payment Recovery

Our retry engine adapts to issuer rules, decline codes, and global timing patterns — recovering failed renewals your billing system misses. No noise, no over-retrying, no additional work.

Unlock Smart RetriesMaximize Approvals

When a transaction fails, we automatically route it to the gateway or MID most likely to succeed — increasing approvals and protecting predictable revenue.

Explore Smart RoutingFraud Defense for Renewals

Behavioral scoring, velocity checks, device intelligence, 3DS orchestration, and chargeback alerts reduce risk before it impacts your MID health.

Protect Account HealthRevenue Intelligence

See exactly where you’re losing money — and where you’re recovering it — with dashboards built for finance teams, treasury leaders, and payment operators.

Get Better ReportingWorks With Your Stack

Whether you use a popular billing platform or a custom solution, Sticky.io adds the missing intelligence layer that improves renewals without disrupting operations.

See All IntegrationsThe Intelligent Subscription Revenue Layer

Sticky.io uses AI-powered retries, smart routing, fraud protection, and real-time insights to reduce churn and improve renewal revenue — without changing your billing system.

Reduce Involuntary Churn

Reduce Involuntary Churn

Retries are timed based on issuer logic, region, BIN, and decline codes — maximizing approval probability on every renewal attempt.

Boost Approval Rates

Boost Approval Rates

Automatically retry failed payments using the gateway most likely to authorize — improving revenue predictability and protecting margin.

Protect MIDs

Protect MIDs

Stop risky transactions before they damage merchant account health with adaptive risk scoring and chargeback prevention.

Forecast With Confidence

Forecast With Confidence

Track approval rates, decline reasons, churn risk, and revenue recovery in a single view tailored for finance and payments teams.

Keep Your Existing Billing

Keep Your Existing Billing

Add intelligent payment recovery to any subscription platform or custom infrastructure.

Make Recurring Revenue Stick

Recover failed payments automatically with AI-powered retries and intelligent routing — the way modern subscription finance teams safeguard predictable revenue.

Why Finance & Payments Teams Choose Sticky.io

AI-powered retry tactics recover more revenue than billing-native tools.

Smart routing across 160+ gateways maximizes transaction success.

Behavioral scoring and intelligent suppression protect MID health.

More renewals recovered = greater LTV, margin stability, and forecasting accuracy.

How Real Brands Improve Renewals, Reduce Churn, and Grow Predictable Revenue

Dive into real stories of businesses who boosted conversions, kept customers longer, and unlocked revenue that used to slip away.

Truly Free Found a Better Way— and Bigger Wins

Sticky.io has given us the ability to take our company and our membership experience to a whole new level. If you’re in the ecommerce world and thinking about subscribing your tribe and giving them a world-class experience, as well as getting scalable insights to how you can grow your company — I really don’t know of another platform I would recommend like Sticky.io.

How SkinnyFit Built Smarter Subscriptions

Partnering with Sticky.io has given us the ability to quickly change and pivot based on what bests resonates with our customers. We’re able to understand our customers on a deeper level and provide more value.

How Flexible Funnels Fueled Floral Commerce Growth

Since we’ve launched subscriptions, it has become a more and more important part of our offering each year as we grow it and as it helps us have that more expected revenue coming in, which is helpful for our farms and our other partners.

How RealDefense Simplified Complex Billing at Scale

If you’re looking for a billing platform that will work with you to solve your business needs, Sticky.io is it.

Your Subscription Revenue Shouldn’t Be Left to Chance

Add intelligent retries, smarter routing, and fraud protection to every renewal — and watch silent churn turn into retained customers, higher LTV, and more predictable revenue.

Connect to the Tools You Already Use

Sticky.io integrates seamlessly with over 400 popular eccomerce integrations like Shopify, WooCommerce, landing page builders, analytics platforms, and over 160 payment gateways — so your existing stack stays intact, and your revenue starts flowing faster.

Traditional Dunning Systems Aren't Built for Recovery — Ours Is

Billing platforms manage subscriptions. Sticky.io safeguards them with intelligent retries, routing, fraud prevention, and recovery automation that turn payment failures into revenue wins.

Answers for Teams Managing Recurring Revenue

Do we need to change our billing system?

No — and that’s the point.

Sticky.io is designed to enhance your existing billing platform, not replace it. Whether you use a leading subscription billing provider or a custom-built system, we integrate via API or webhooks to add an intelligent recovery and routing layer on top.

Your billing system continues to manage subscriptions and invoices. Sticky.io adds:

- AI-powered retry logic

- Smart routing and cascading

- Fraud and chargeback protection

- Real-time renewal analytics

You keep the system you trust. We make it smarter.

Can Sticky.io help with initial and recurring declines?

Yes — we optimize both first-attempt and recurring subscription declines.

Initial declines impact acquisition and CAC efficiency. Renewal declines impact retention and LTV. Sticky.io addresses both with issuer-aware retry timing, decline-code logic, and intelligent routing across gateways.

That means:

- Higher first-attempt approval rates

- More recovered renewals

- Lower involuntary churn

- Stronger lifetime value

We don’t just retry payments. We optimize when, how, and where they’re retried.

How much additional revenue can we recover?

It depends on your decline rates, vertical, gateway mix, and current dunning strategy — but many enterprise subscription brands recover 40–75% of failed recurring payments.

Most billing-native dunning systems use fixed retry schedules. Sticky.io adapts retry timing based on issuer behavior, decline codes, BIN data, region, and historical performance patterns.

The result: materially higher recovery rates without increasing customer friction or chargeback risk.

We provide a recovery assessment to estimate your potential uplift before you commit.

Does this help reduce fraud and chargebacks?

Yes — and that protection extends beyond recovery.

Failed payments and fraud are often connected. Aggressive retrying without intelligence can increase disputes and damage merchant account health.

Sticky.io includes:

- Behavioral risk scoring

- Velocity checks

- Device intelligence and fingerprinting

- 3DS orchestration

- Chargeback monitoring and alerts

- Intelligent retry suppression to prevent over-attempting

This protects your MIDs, keeps ratios in healthy ranges, and ensures recovery efforts don’t create downstream risk.

How long does implementation take?

Most subscription businesses integrate in a matter of weeks — not months.

Implementation typically involves:

- Connecting via API or webhook

- Configuring retry logic and routing rules

- Connecting gateways or MIDs (if needed)

- Setting up dashboards and reporting

Our team works alongside your payments and engineering teams to ensure a smooth rollout with no disruption to billing operations.

Are retries optimized globally?

Absolutely!

Issuer behavior varies by region, bank, card network, and market conditions. A retry strategy that works in the U.S. may fail in Europe or LATAM.

Sticky.io’s recovery engine adapts retry timing and routing logic based on:

- Issuer and BIN behavior

- Regional authorization patterns

- Decline reason codes

- Gateway performance data

This ensures global subscription businesses can maximize renewal approvals without manually tuning strategies market by market.

Turn Silent Churn Into Revenue

Most failed renewals aren’t lost customers — they’re failed payments. See how much revenue AI-powered retries and smart routing can recover for your subscription business.