Easily Integrate with Any System via API

Sticky.io is a headless, API-driven CRM and payments platform designed to support complex commerce architectures. It gives marketing and finance the flexibility they need — while giving product and tech teams control, visibility, and clean integrations.

Infrastructure Built to Perform at Scale

Sticky.io is battle-tested infrastructure, not a lightweight tool. With support for 160+ gateways, billions in annual volume, and tens of millions of subscriptions managed, we power complex payment and billing ecosystems without slowing teams down.

160+ Payment Gateways

400+ Tech Integrations

Open API Access

500+ Pre-Built Integrations & Counting

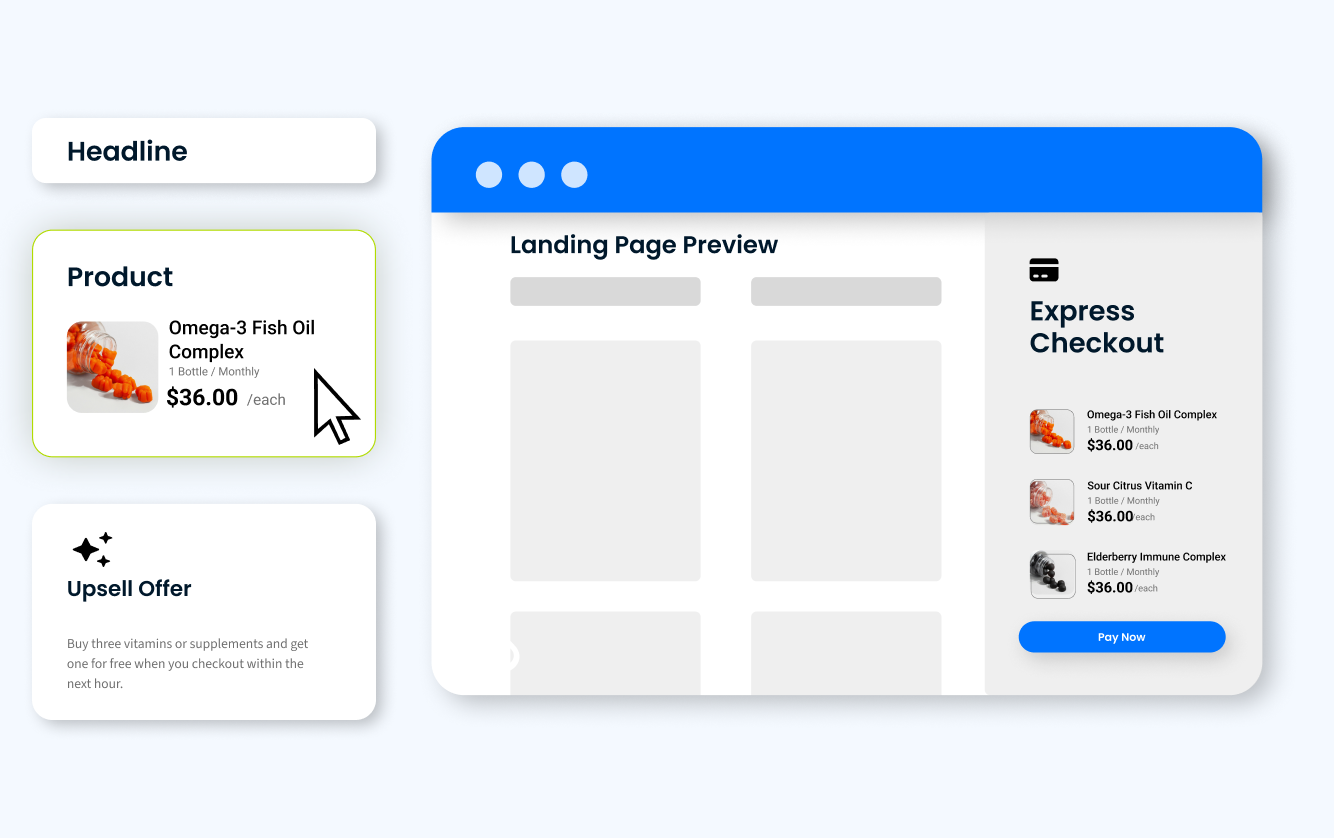

Sticky.io acts as a flexible revenue layer — handling subscriptions, billing, payments, and recovery — while fitting cleanly into modern ecommerce, headless, and hybrid stacks.

Use Sticky.io as the system of record for customers, subscriptions, offers, and transactions — without dictating front-end experiences or forcing UI constraints.

Explore CRM Architecture

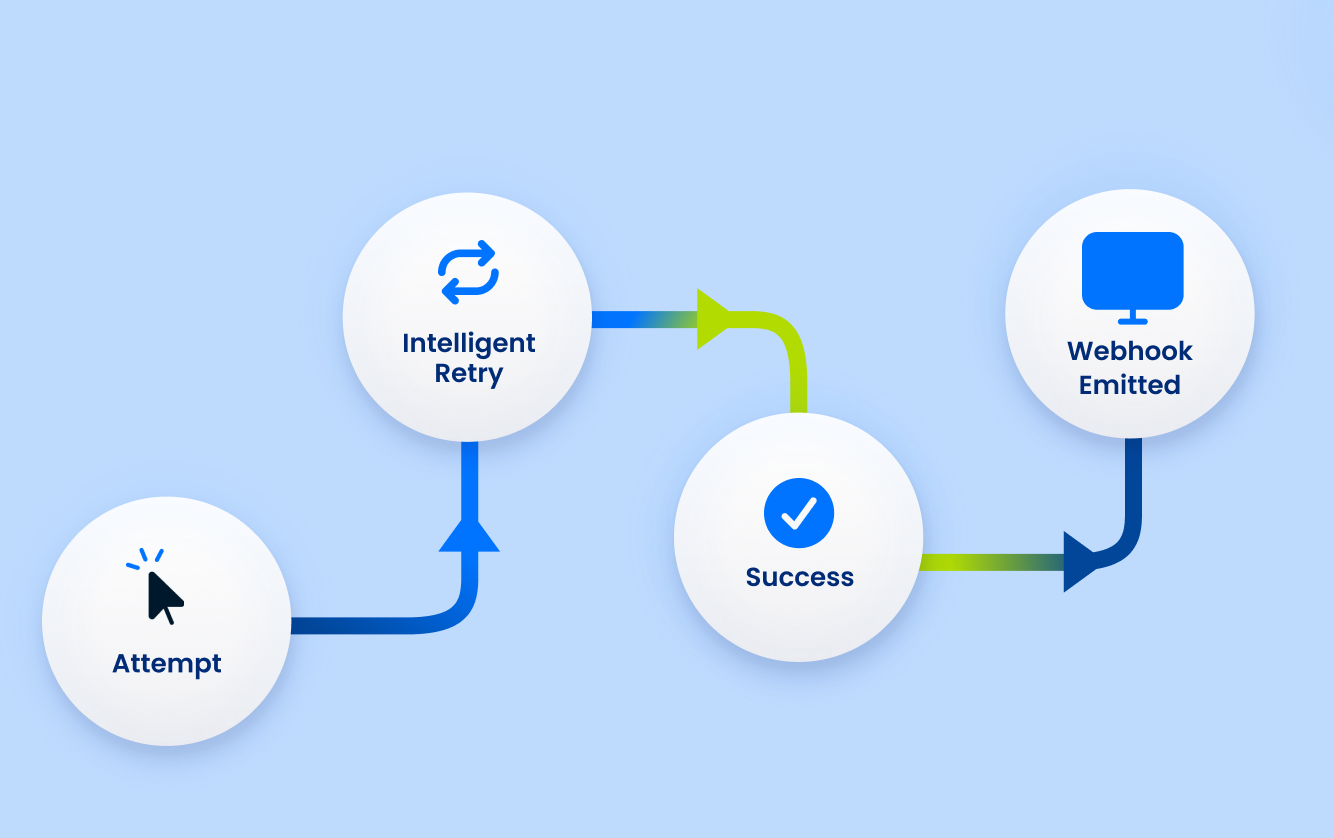

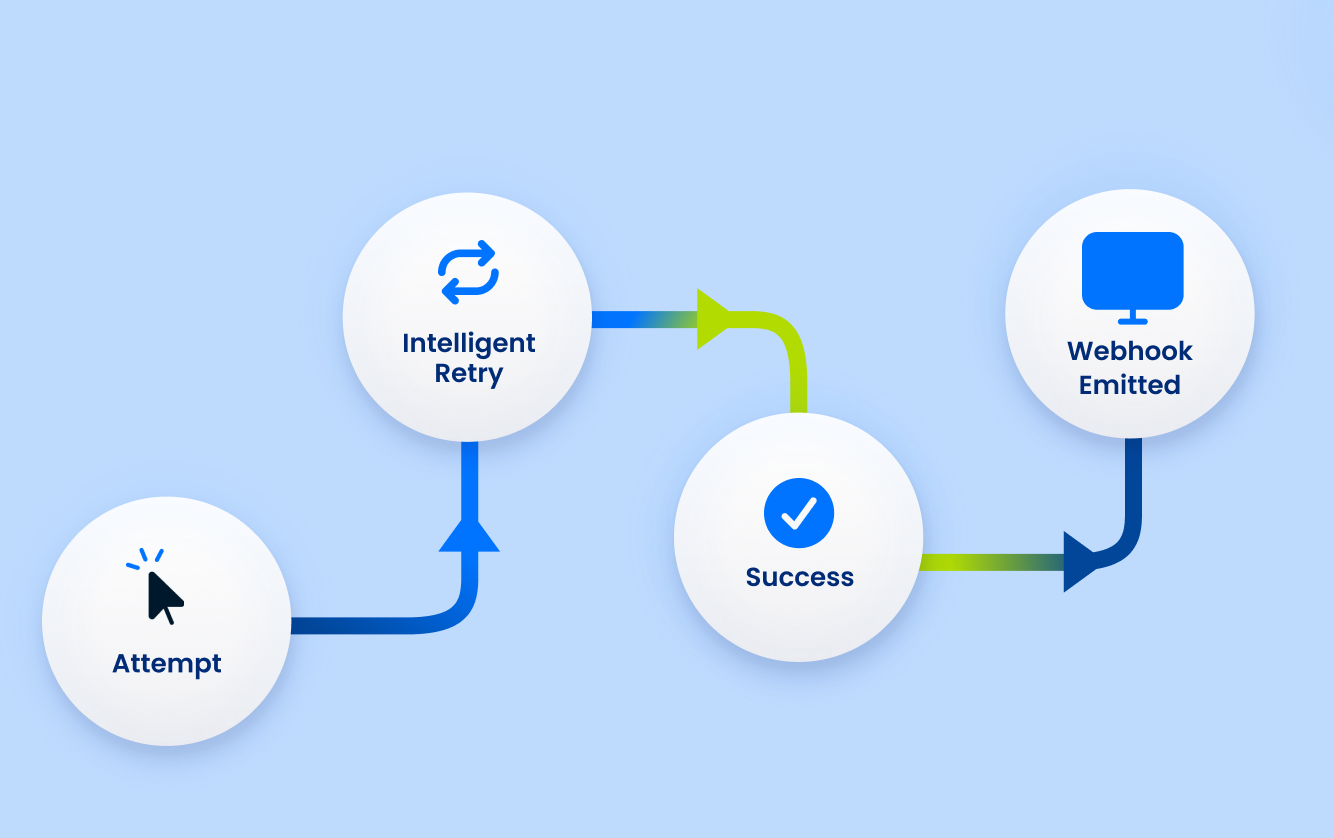

Every core function is exposed via APIs and webhooks, allowing teams to integrate billing, payments, and lifecycle events into existing systems and workflows.

View API Documentation

Native integrations and partner connections reduce build time, while APIs support custom flows where needed — without locking teams into rigid patterns.

Browse Integrations

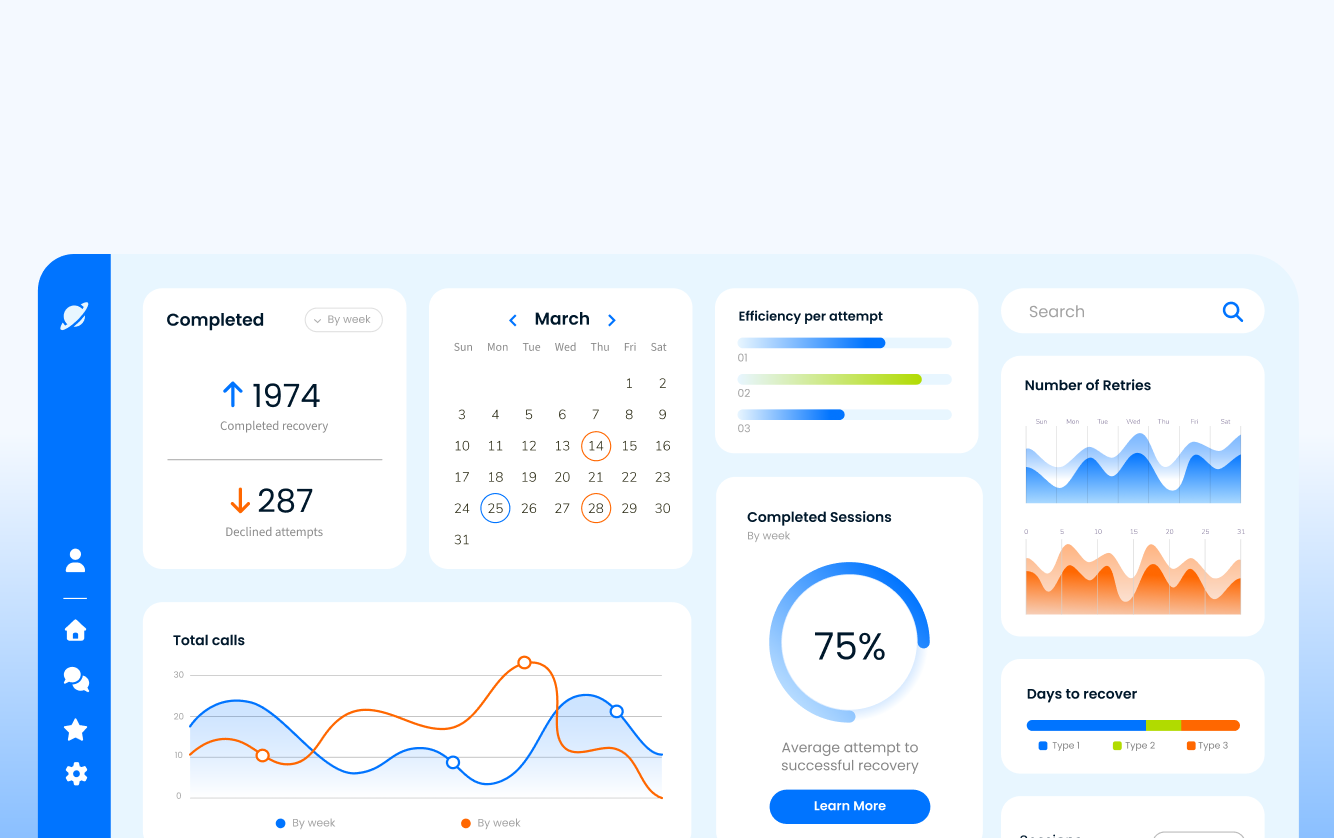

Access detailed reporting on approvals, declines, churn, recovery, and cohort performance — with data structured for operational and financial analysis.

See Reporting Capabilities

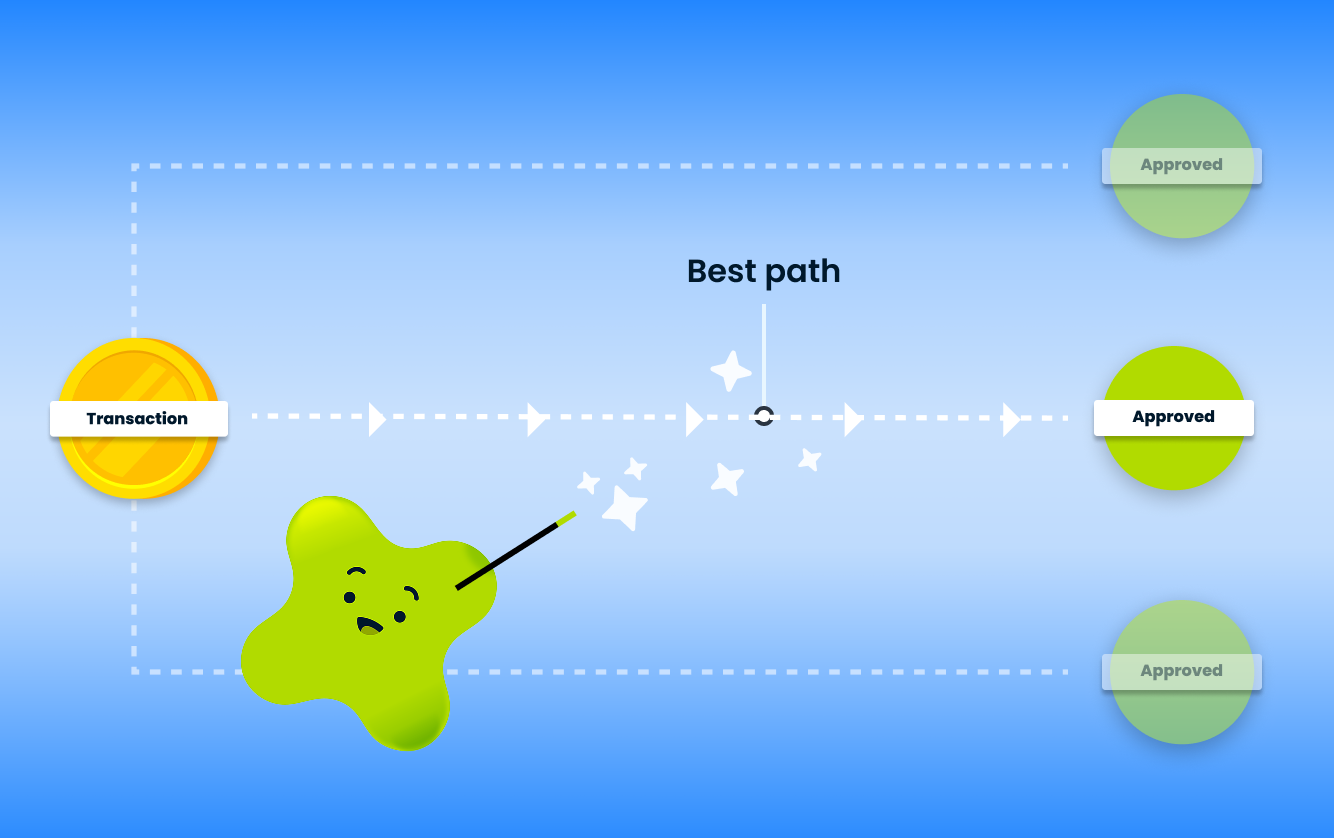

Support multiple gateways, routing rules, retries, fraud signals, and chargeback workflows — without building and maintaining custom logic.

Explore Payments CapabilitiesHeadless CRM

Use Sticky.io as the system of record for customers, subscriptions, offers, and transactions — without dictating front-end experiences or forcing UI constraints.

Explore CRM ArchitectureAPI-First Integrations

Every core function is exposed via APIs and webhooks, allowing teams to integrate billing, payments, and lifecycle events into existing systems and workflows.

View API Documentation500+ Existing Integrations

Native integrations and partner connections reduce build time, while APIs support custom flows where needed — without locking teams into rigid patterns.

Browse IntegrationsUnified Reporting

Access detailed reporting on approvals, declines, churn, recovery, and cohort performance — with data structured for operational and financial analysis.

See Reporting CapabilitiesPayments Your Way

Support multiple gateways, routing rules, retries, fraud signals, and chargeback workflows — without building and maintaining custom logic.

Explore Payments CapabilitiesHow Teams Use Sticky.io Across Their Tech Stack

Different teams interact with Sticky.io differently — our platform adapts to each role without creating silos.

Product Teams

Product Teams

Keep your front-end and internal systems intact while Sticky.io handles funnels and payments complexity behind the scenes.

Tech Teams

Tech Teams

APIs, webhooks, and stable data models reduce implementation risk and ongoing maintenance.

Marketing Teams

Marketing Teams

Marketing teams manage offers and subscriptions without requiring engineering support for every change.

Finance Teams

Finance Teams

Track approvals, declines, recovery, and churn in one reporting dashboard with real-time insights.

Operations Teams

Operations Teams

Built-in controls help manage fraud, chargebacks, and gateway performance at scale.

See How Sticky Stacks Up with Existing Systems

Sticky.io fits into your architecture so you can move faster without rewriting what already works.

What Sets Sticky Apart

Sticky.io connects cleanly to your existing stack with flexible APIs, webhooks, and data access that keep systems talking and teams moving. Plug in what you need, keep what already works, and avoid ripping out core infrastructure.

We process $12B+ in annual transaction volume across high-growth, high-complexity businesses. That means real-world reliability under peak load, global traffic, and edge cases — not theoretical performance.

Subscriptions don’t break us — they’re the point. From recurring billing and intelligent retries to multi-gateway routing and risk management, Sticky.io handles the hard parts natively. No broken workarounds or fingers crossed.

Protect your processing. Our platform is designed to safeguard merchant health, maintain approval rates, and reduce downstream risk — so revenue keeps flowing even as volume, complexity, and regulation increase.

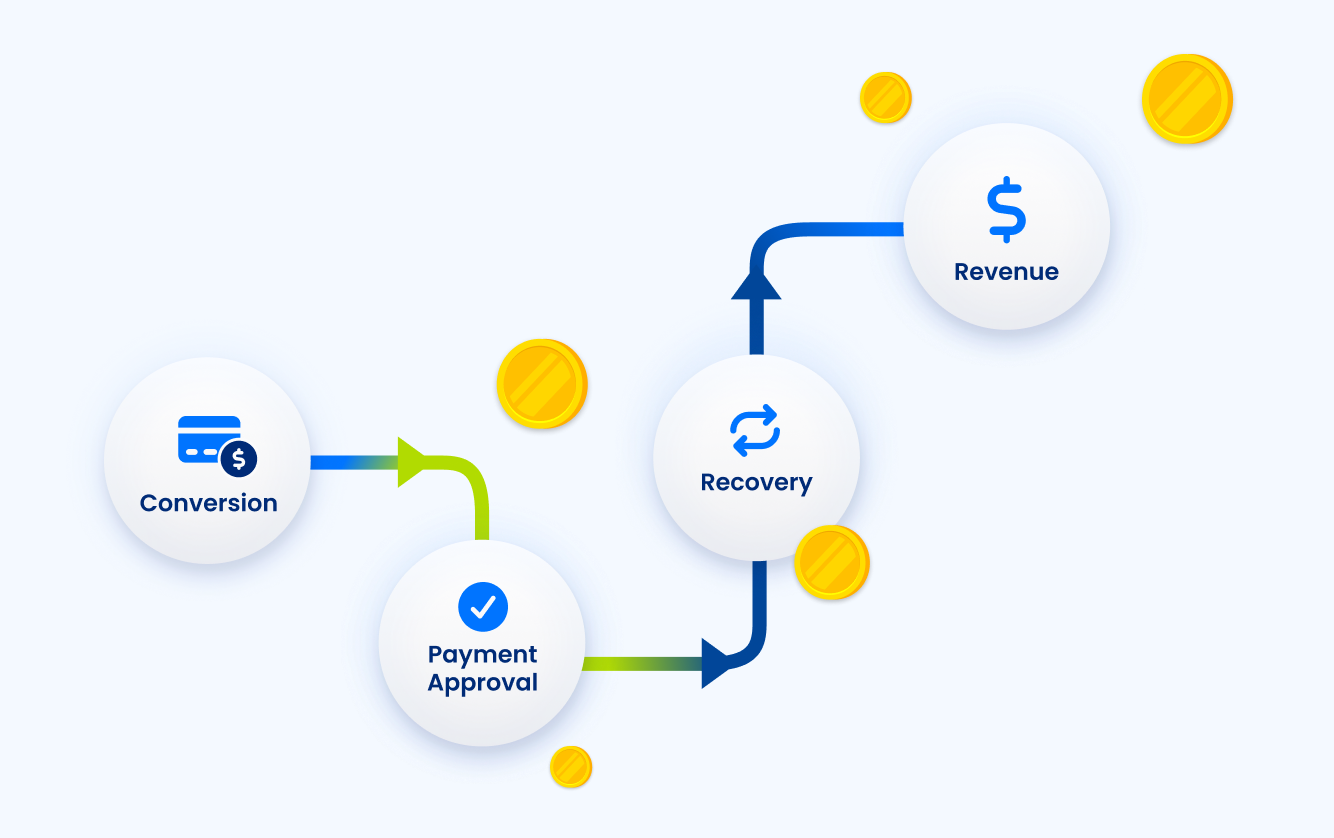

How Real Brands Improve Renewals, Reduce Churn, and Grow Predictable Revenue

Dive into real stories of businesses who boosted conversions, kept customers longer, and unlocked revenue that used to slip away.

Truly Free Found a Better Way— and Bigger Wins

Sticky.io has given us the ability to take our company and our membership experience to a whole new level. If you’re in the ecommerce world and thinking about subscribing your tribe and giving them a world-class experience, as well as getting scalable insights to how you can grow your company — I really don’t know of another platform I would recommend like Sticky.io.

How SkinnyFit Built Smarter Subscriptions

Partnering with Sticky.io has given us the ability to quickly change and pivot based on what bests resonates with our customers. We’re able to understand our customers on a deeper level and provide more value.

How Flexible Funnels Fueled Floral Commerce Growth

Since we’ve launched subscriptions, it has become a more and more important part of our offering each year as we grow it and as it helps us have that more expected revenue coming in, which is helpful for our farms and our other partners.

How RealDefense Simplified Complex Billing at Scale

If you’re looking for a billing platform that will work with you to solve your business needs, Sticky.io is it.

Connect to the Tools You Already Use

Sticky.io integrates seamlessly with over 400 popular eccomerce integrations like Shopify, WooCommerce, landing page builders, analytics platforms, and over 160 payment gateways — so your existing stack stays intact, and your revenue starts flowing faster.

Payments Infrastructure Without Custom Builds

Sticky.io handles routing, retries, recovery, and risk so your team doesn’t have to maintain complex payment logic.

FAQs from Teams Who Own the Tech Stack

Is Sticky.io a headless CRM and revenue platform?

Yes — and that distinction matters.

Sticky.io operates as a headless CRM and payments platform, meaning we manage subscriptions, customers, transactions, offers, billing logic, and recovery — without dictating your frontend experience.

You maintain full control over:

- Frontend frameworks (Next.js, React, custom apps, etc.)

- CMS or ecommerce layer

- Internal tooling

- Data pipelines

Sticky.io acts as a revenue layer behind the scenes — structured, API-driven, and composable — so your architecture stays clean while payments and subscription logic scale with you.

If you're building a headless, composable, or hybrid commerce stack, Sticky.io fits naturally into that model.

Does Sticky.io offer open APIs, webhooks, and custom integrations?

Yes. Sticky.io is API-first.

Every core function — subscriptions, transactions, customer updates, retries, routing, lifecycle events — is exposed through REST APIs and webhooks.

That means you can:

- Trigger custom workflows on payment events

- Sync subscription state with internal systems

- Feed transaction data into BI tools

- Automate lifecycle events

- Build custom dashboards or reporting layers

We don’t hide functionality behind UI constraints. If it happens in Sticky.io, it’s accessible programmatically.

How does Sticky.io integrate with existing ecommerce platforms and tools?

Sticky.io integrates in two primary ways:

- Native integrations and pre-built connectors ( 500+ ecommerce platforms, gateways, fraud tools, analytics systems, etc.)

- API and webhook-based custom integrations

You can use Sticky.io as:

- A subscription and billing engine behind Shopify or other storefronts

- A headless CRM connected to custom frontend experiences

- A payments orchestration layer across multiple gateways

- A data source feeding internal dashboards and finance systems

No forced replatform. No rigid implementation path. Integration is incremental and adaptable to your architecture.

Can Sticky.io work with our existing payment gateways and processors?

Yes — and that’s often the starting point.

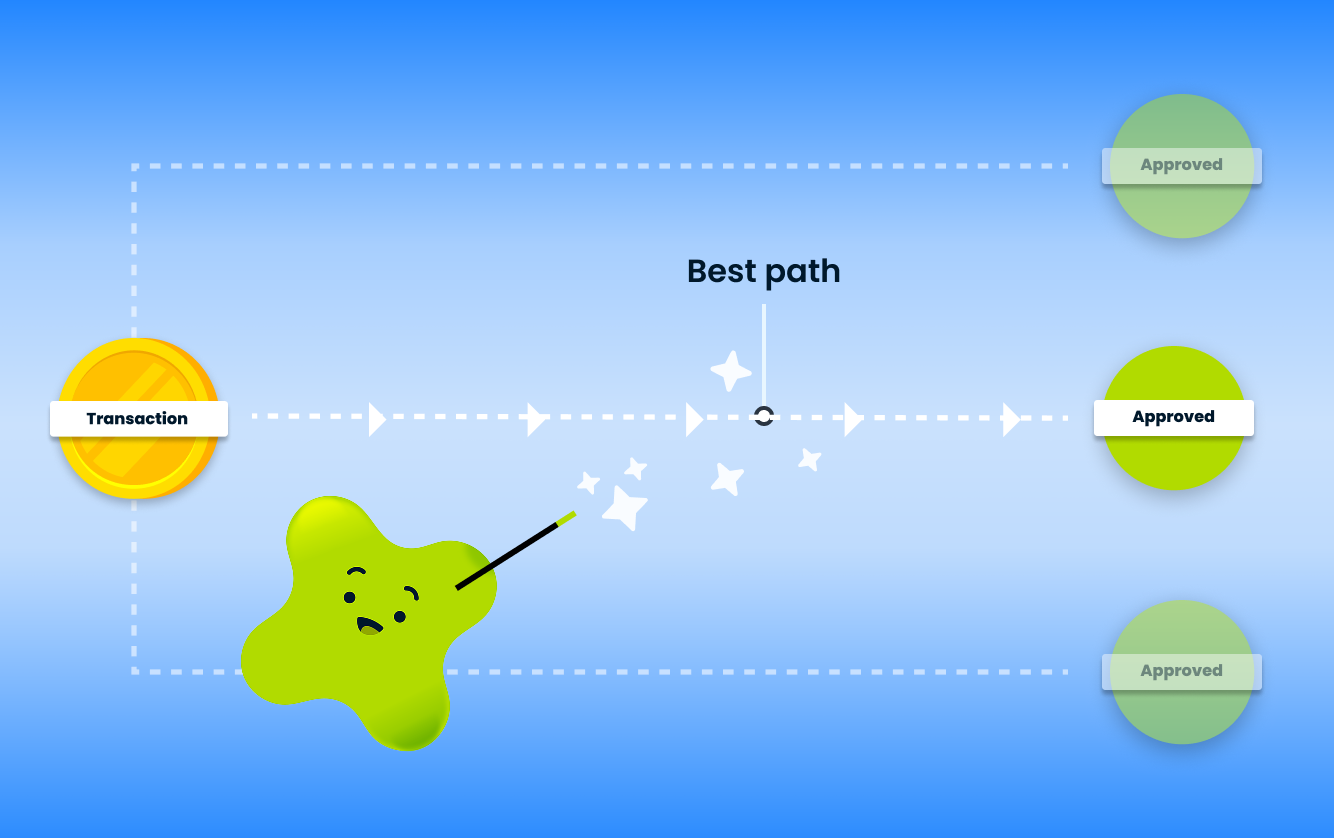

Sticky.io supports 160+ gateways and processors, allowing you to maintain existing acquiring relationships while adding:

- Smart routing and cascading

- AI-powered retry logic

- Multi-MID support

- Recovery optimization

- Fraud and chargeback workflows

You don’t lose control of your payments stack. You gain intelligence across it.

If you require a specific gateway or regional processor, our team can evaluate support and integration paths.

What kind of reporting and analytics does Sticky.io provide?

Sticky.io provides structured reporting across:

- Offer performance

- Campaign adoption rates

- Checkout conversion rates

- Affiliate revenue

- Subscription renewals and upsells

- Approval and decline rates

- Retry success

- Recovery lift

- Churn trends

- Cohort behavior

- MID and gateway performance

Data is accessible via:

- Real-time dashboards

- Exportable reports

- API access for BI ingestion

This makes it suitable for finance, payments operations, RevOps, and data teams who require clean, queryable revenue data — not just surface-level metrics.

Is Sticky.io easy to implement for technical teams?

Implementation is designed to align with modern engineering workflows.

Most teams integrate via:

- REST APIs

- Webhooks

- Gateway connections

- Authentication keys

- Standardized data models

Because Sticky.io does not require frontend replacement, teams can integrate incrementally — starting with payment orchestration or recovery before expanding into CRM or subscription logic.

Our solutions architecture team supports implementation to reduce risk and ensure alignment with your internal systems.

Can Sticky.io replace custom-built subscription or payment logic?

In many cases, yes.

Many teams initially build custom retry logic, routing rules, and subscription workflows internally. Over time, that logic becomes complex, brittle, and expensive to maintain.

Sticky.io replaces:

- Homegrown dunning systems

- Hardcoded gateway routing

- Manual retry scheduling

- Patchwork fraud rules

- Disconnected subscription tracking

You reduce maintenance overhead while gaining enterprise-grade payment intelligence.

Is Sticky.io built for enterprise scale?

Yes.

Sticky.io processes $12B+ in annual transaction volume and supports 72M+ subscriptions across industries. The infrastructure is designed for:

- High transaction throughput

- Multi-region routing

- Complex subscription models

- Multi-MID architectures

- Compliance-aware workflows

This isn’t a lightweight plugin. It’s revenue infrastructure.