Stop Losing Revenue You’ve Already Earned

Involuntary customer churn quietly erodes growth long before it shows up in your reports. Sticky.io helps you prevent involuntary churn, recover failed payments, and keep more subscribers active month after month.

Reduce Churn

Churn Is a System Problem

You can’t reduce churn with emails alone. Real retention requires adaptive billing, smarter retries, and payment orchestration that responds in real time.

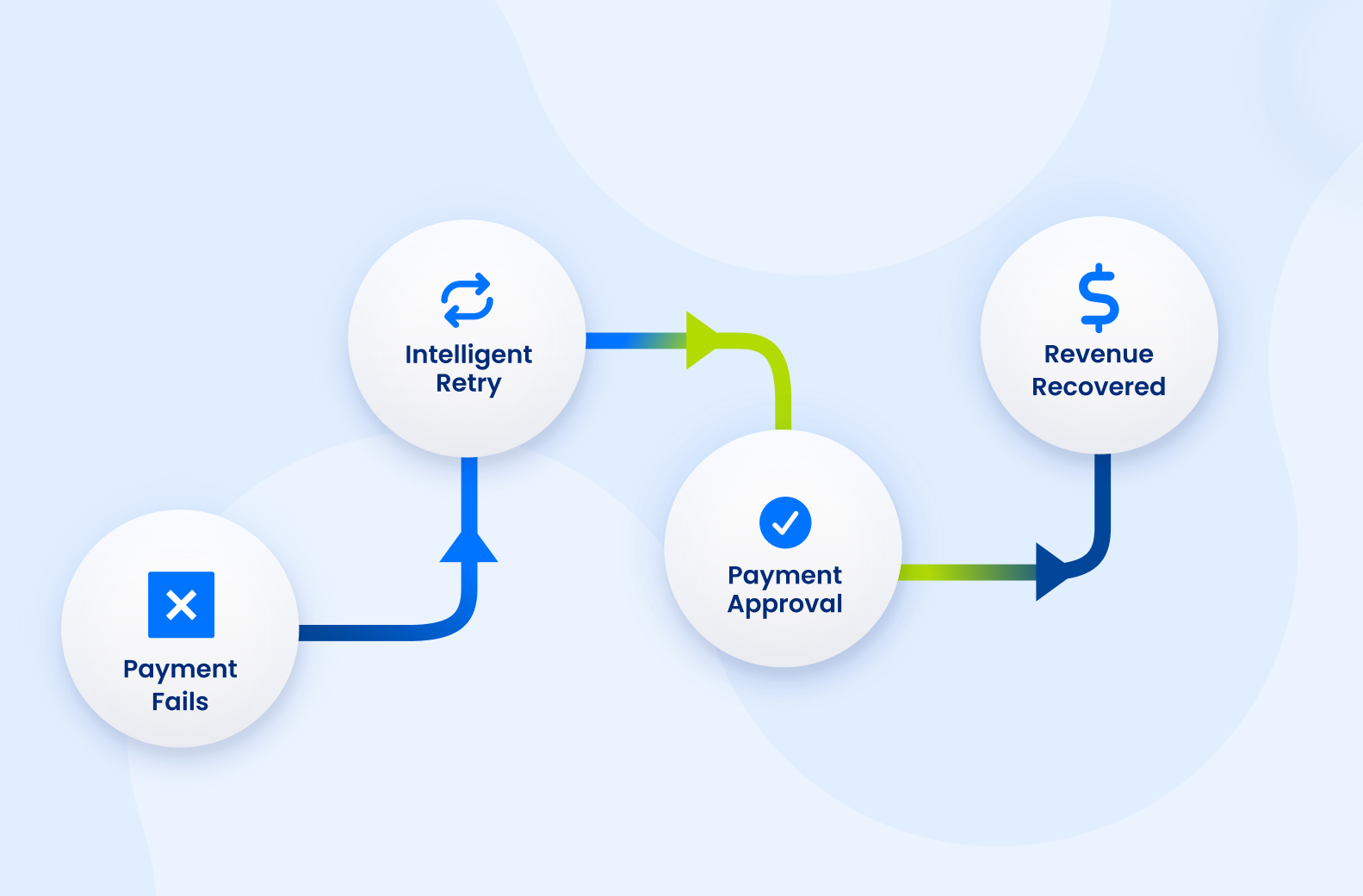

Recover Failed Payments Automatically

Most subscription churn happens when payments fail — not when customers choose to leave. Sticky.io uses intelligent retries, issuer-aware timing, and adaptive logic to recover failed payments before subscribers ever drop.

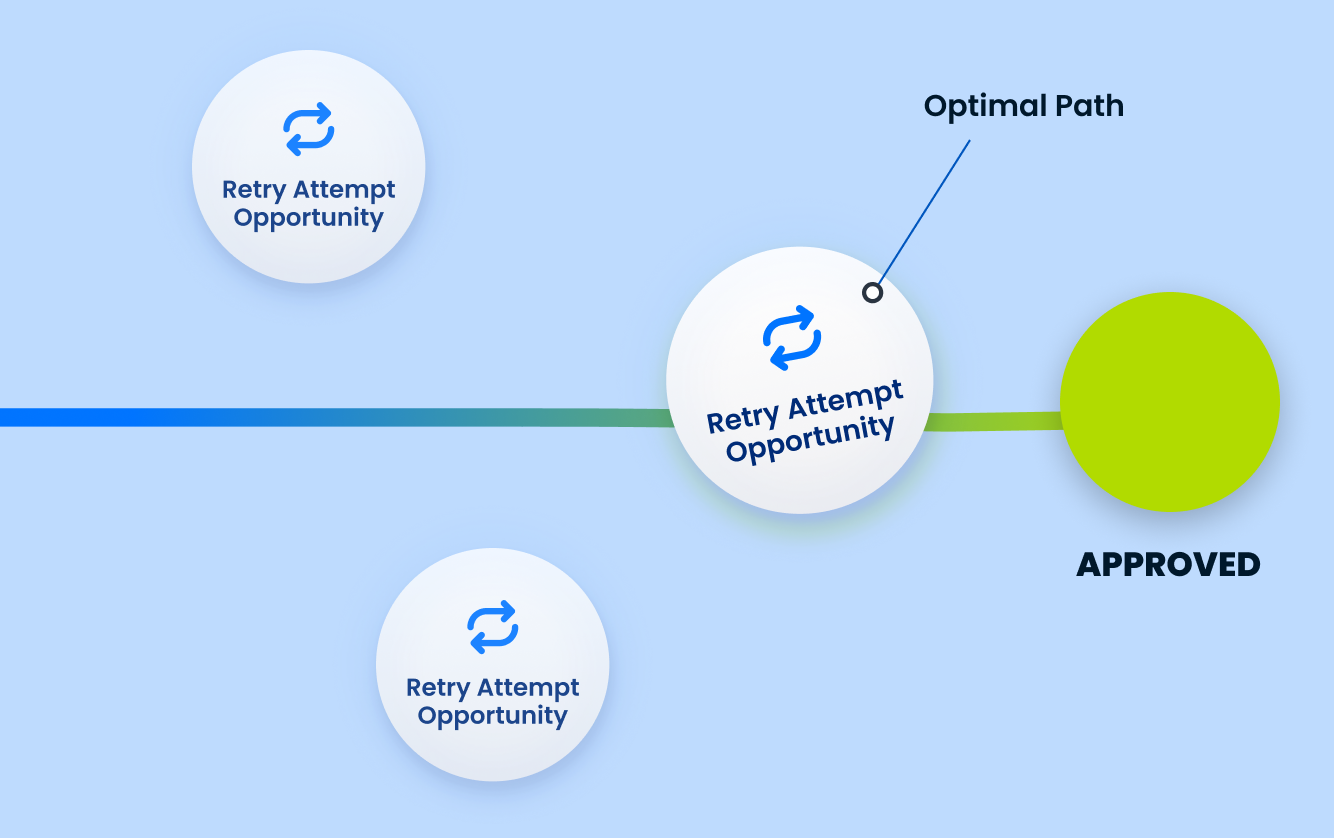

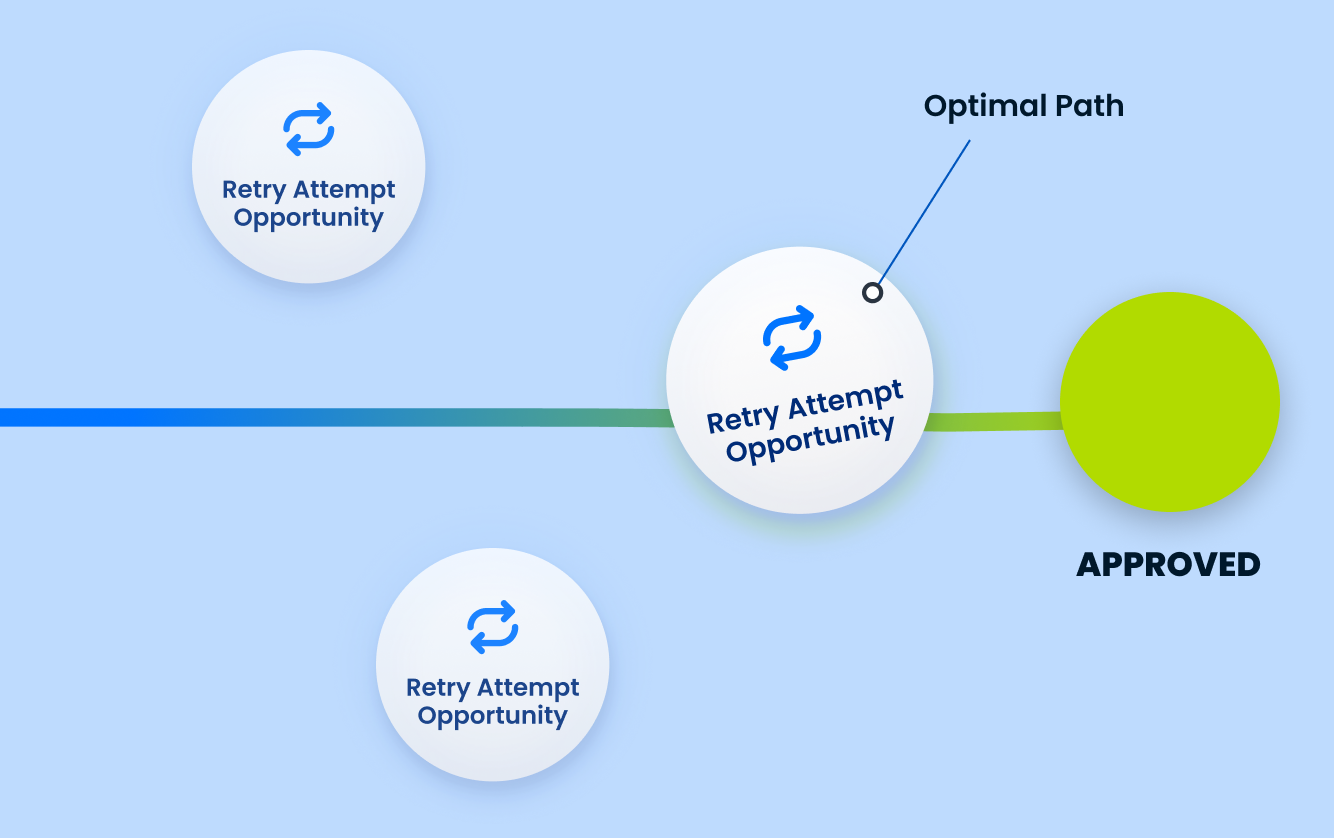

Retry Payments the Smart Way

Not every retry should happen the same way. Sticky.io uses issuer-aware timing, decline intelligence, and adaptive logic to retry payments when they’re most likely to succeed — preventing churn before it starts.

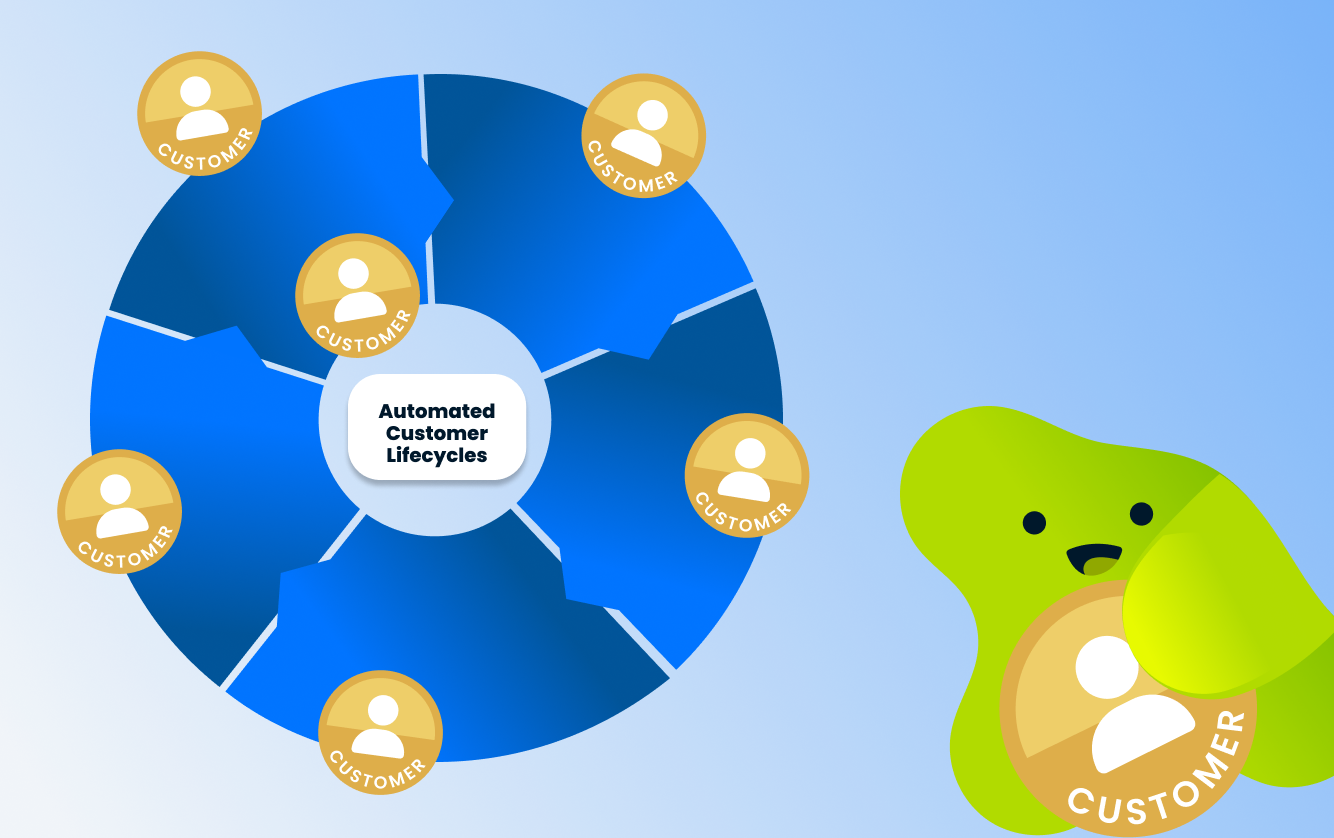

Manage the Entire Subscriber Lifecycle

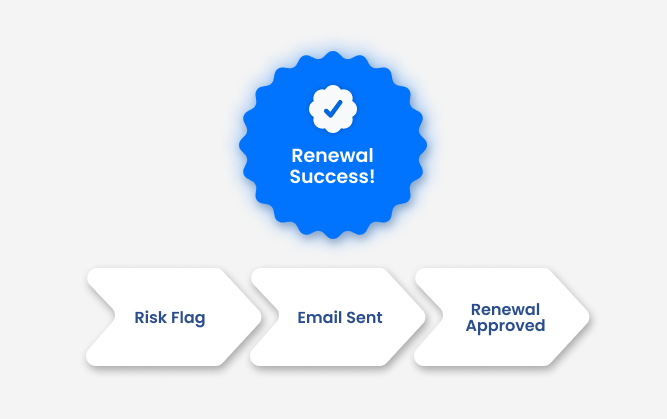

Churn isn’t a single moment. Sticky.io gives you control over every stage of the subscriber lifecycle — from signup to renewal to recovery — so fewer customers fall through the cracks.

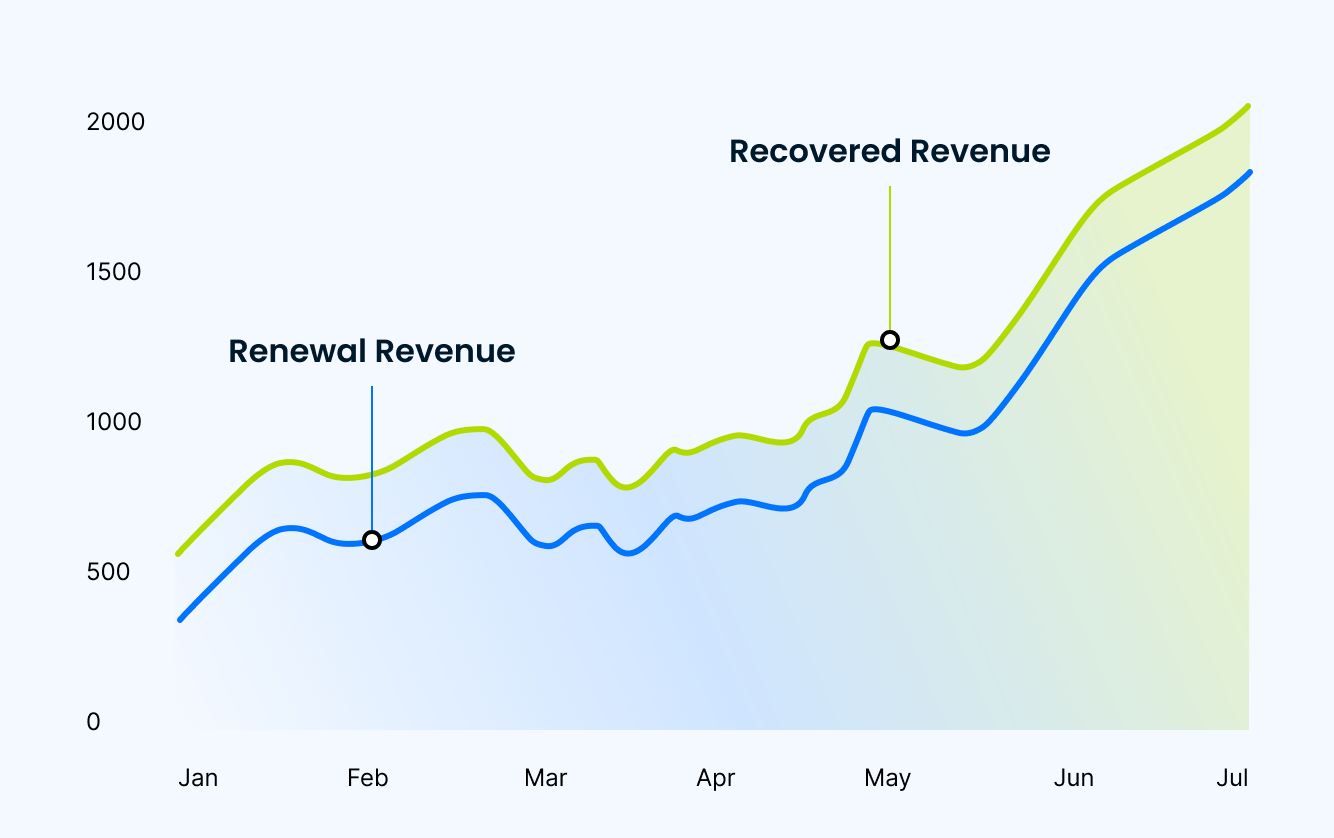

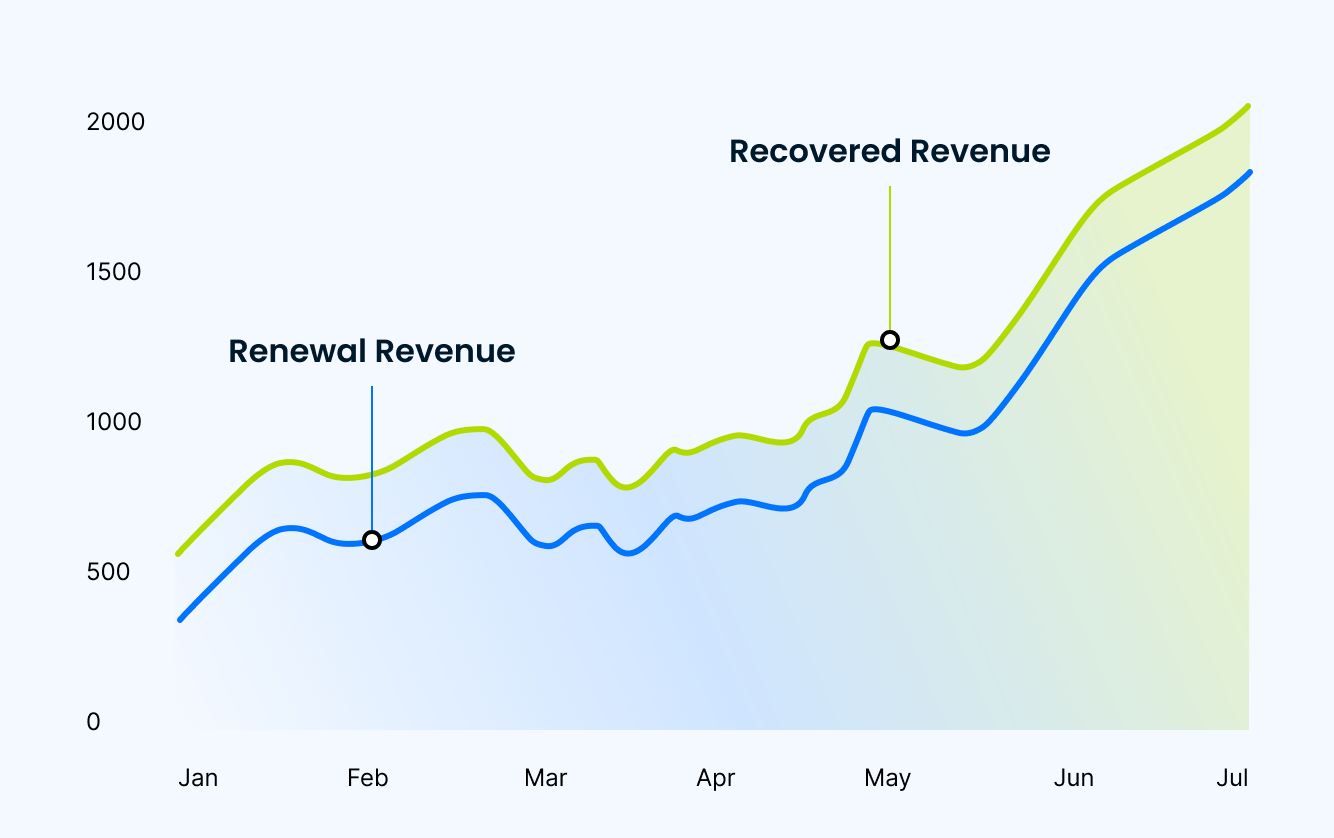

One Unified Command Center for Retention Analytics

Eliminate data silos. By unifying subscription, payment, and recovery metrics into a single analytical engine, Sticky.io provides a high-fidelity view of your health. Monitor real-time efficiency and identify high-risk churn patterns before they impact your bottom line.

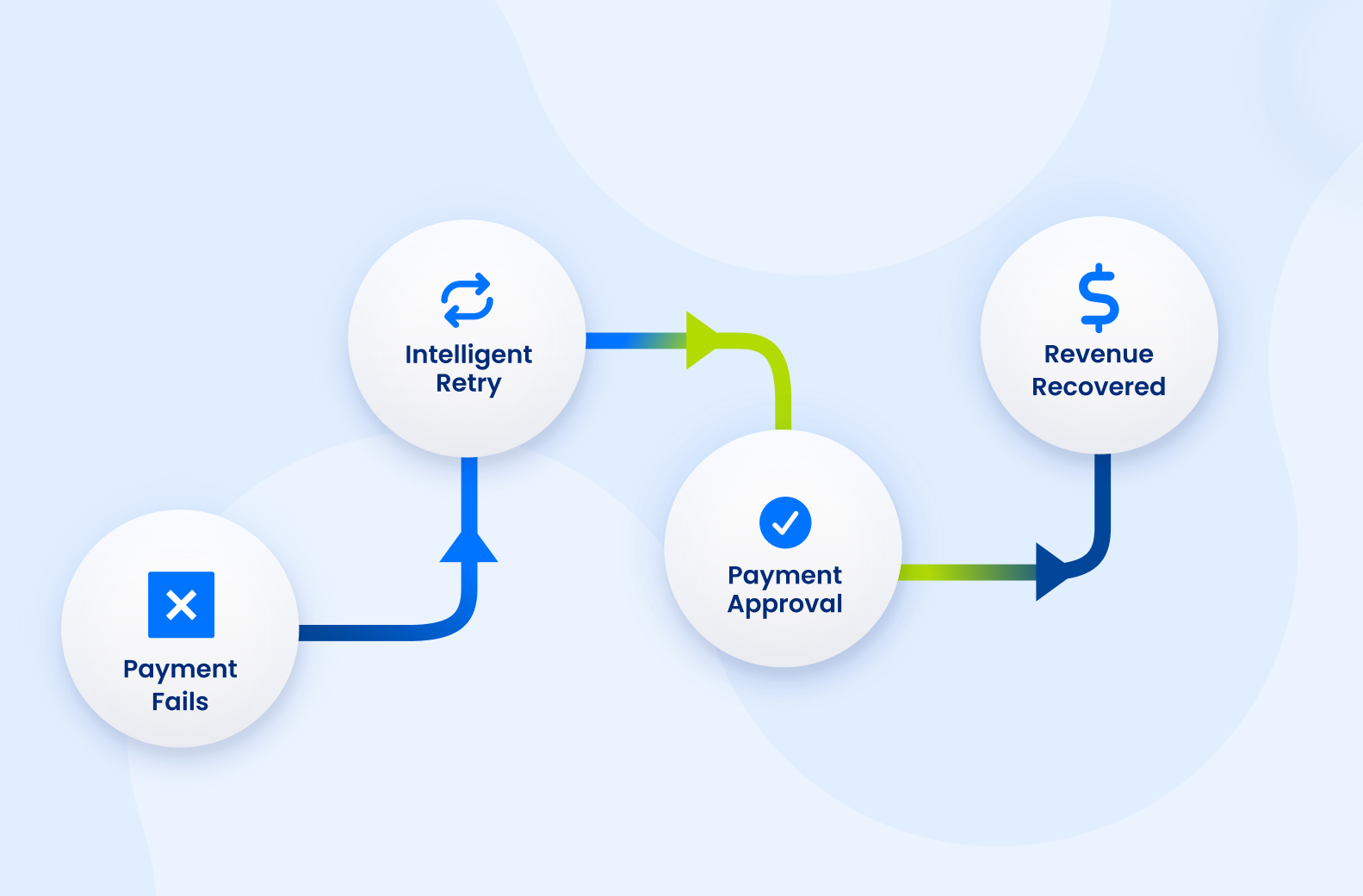

A renewal payment fails due to issuer decline, expired card, or temporary bank issue — a common starting point for involuntary churn.

Sticky.io evaluates decline reason, issuer behavior, and timing to determine the best moment to retry — improving success without customer disruption.

If needed, Sticky.io automatically routes the transaction through the best-performing gateway to maximize approval rates.

The payment is approved and the subscription remains active — without the customer ever noticing an issue.

With the renewal complete, the subscriber continues uninterrupted — preserving lifetime value and reducing churn over time.

Sticky.io captures renewal and recovery insights across the lifecycle, helping teams continuously reduce churn at scale.

Payment Fails

A renewal payment fails due to issuer decline, expired card, or temporary bank issue — a common starting point for involuntary churn.

Smart Retry

Sticky.io evaluates decline reason, issuer behavior, and timing to determine the best moment to retry — improving success without customer disruption.

Best Route

If needed, Sticky.io automatically routes the transaction through the best-performing gateway to maximize approval rates.

Approval Secured

The payment is approved and the subscription remains active — without the customer ever noticing an issue.

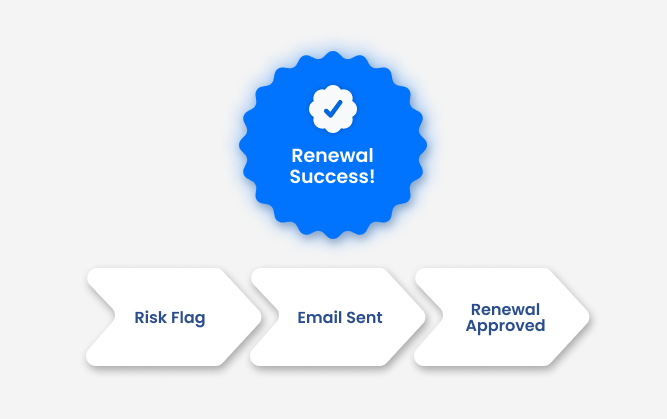

Subscriber Retained

With the renewal complete, the subscriber continues uninterrupted — preserving lifetime value and reducing churn over time.

Insights Applied

Sticky.io captures renewal and recovery insights across the lifecycle, helping teams continuously reduce churn at scale.

Build a System That Keeps Revenue

Proven Churn Reduction at Scale

From higher approval rates to millions in recovered revenue, see how Sticky.io helps brands reduce involuntary churn across complex subscription businesses.

Truly Free Found a Better Way— and Bigger Wins

Sticky.io has given us the ability to take our company and our membership experience to a whole new level. If you’re in the ecommerce world and thinking about subscribing your tribe and giving them a world-class experience, as well as getting scalable insights to how you can grow your company — I really don’t know of another platform I would recommend like Sticky.io.

How SkinnyFit Built Smarter Subscriptions

Partnering with Sticky.io has given us the ability to quickly change and pivot based on what bests resonates with our customers. We’re able to understand our customers on a deeper level and provide more value.

How Flexible Funnels Fueled Floral Commerce Growth

Since we’ve launched subscriptions, it has become a more and more important part of our offering each year as we grow it and as it helps us have that more expected revenue coming in, which is helpful for our farms and our other partners.

How RealDefense Simplified Complex Billing at Scale

If you’re looking for a billing platform that will work with you to solve your business needs, Sticky.io is it.

Churn Reduction, Explained

What is churn, and why does it matter for subscription businesses?

Churn is the loss of subscribers or recurring revenue over time. For subscription businesses, even small increases in churn compound quickly, reducing lifetime value, weakening revenue predictability, and increasing pressure on acquisition spend. Reducing churn is one of the most effective ways to grow revenue without increasing marketing costs.

What causes involuntary churn?

Involuntary churn happens when customers are lost due to failed payments rather than intentional cancellations. Common causes include expired cards, temporary issuer declines, insufficient funds, and rigid retry logic. These failures often happen silently and can account for a significant portion of overall churn if left unaddressed.

How does Sticky.io reduce churn caused by failed payments?

Sticky.io reduces involuntary churn by intelligently retrying and rerouting failed transactions. The platform uses issuer-aware timing, decline-code intelligence, and adaptive routing to recover payments before subscriptions are canceled, recovering up to 650% more failed payments than traditional approaches.

How is this different from traditional dunning or retry tools?

Traditional dunning relies on static retry schedules and customer emails, which don’t address why payments fail. Sticky.io focuses on fixing the payment system itself by optimizing approval rates, routing transactions dynamically, and retrying payments at the right moment — often without customer intervention.

Can Sticky.io help reduce churn beyond failed payments?

Yes. Sticky.io helps reduce voluntary and passive churn by giving businesses control over the full subscription lifecycle. This includes flexible billing logic, lifecycle offers, subscription management, and real-time visibility into churn drivers, all managed from a single system.

How does improving payment approvals reduce churn?

Higher approval rates mean fewer failed renewals and fewer unnecessary cancellations. Sticky.io improves approvals by intelligently routing transactions, adapting to issuer behavior, and optimizing retry timing, resulting in up to 40% higher initial payment approvals and less silent churn.

Is Sticky.io built to support churn reduction at scale?

Yes. Sticky.io processes over $10B annually and supports more than 72 million subscriptions. The platform is designed to reduce churn across high-volume subscription businesses without adding operational complexity or manual effort.

Build a System That Keeps Revenue Flowing

Churn doesn’t fix itself. Add intelligent retries, adaptive routing, and full lifecycle visibility to protect renewals and keep more customers active — month after month.