Learn how to offer the feature-rich experience consumers crave. Read the April 2023 Subscription Commerce Readiness Report to get the details on subscription cancellation patterns and conversion trends.

There are three metrics you need to monitor frequently if you want your ecommerce subscription business to thrive:

- Churn rate.

- Monthly recurring revenue.

- Average order value.

However, these metrics alone aren’t the key to success for your consumer brand. For example, a company with a 1% churn rate, over $100,000 in monthly recurring revenue (MRR), and a growing average order value (AOV) could still be about to fail.

Your success as a subscription merchant hinges on your LTV:CAC ratio — the comparison between your customer lifetime value (LTV) and customer acquisition cost (CAC).

A profitable business must earn more from each customer than it spends to acquire them. Your LTV:CAC ratio tells you whether you’re succeeding at this goal. It’s a direct measure of your profitability.

This ratio isn’t set, either. It can and will fluctuate, so it needs to be calculated annually. You may actually want to do so quarterly or monthly if you’re changing your subscription offerings or struggling to keep your customers around.

Take a few minutes to go through this step-by-step guide on how to calculate and interpret your LTV:CAC ratio. You’ll end up with a greater understanding of your business and know where to look for new growth opportunities.

how to calculate your LTV:CAC ratio

Step 1: find your gross margin

Your gross margin is the amount of profit made from each sale. This number is easy to calculate. Simply subtract the cost of goods sold (COGS) from your revenue, then divide the resulting number by that revenue.

Your gross margin is expressed as a percent. The higher the percentage, the more you profit with each sale.

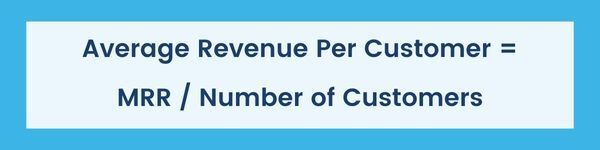

Step 2: calculate your average revenue per customer

The average revenue per customer (ARPC) is a simple measure of how much a single customer pays your company in an average subscription period. Assuming your subscriptions run on a monthly schedule, divide your MRR by the number of active subscribers you have that month.

If you offer subscriptions with a longer billing period or variable terms, look instead at quarterly recurring revenue and subscriber counts for a more accurate idea of your ARPC. Just make sure you turn whatever number you get into an average monthly ARPC. To do so, divide your result by the number of months in the period you used (three for quarterly recurring revenue, 12 for annual recurring revenue). Otherwise, your LTV will look much higher than it actually is.

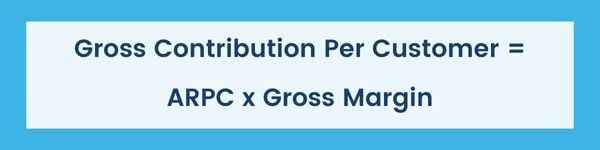

Step 3: find your gross contribution per customer

Your gross contribution per customer is the profit you earn from a subscriber each month. Find this number by multiplying your ARPC — the amount your average customer pays you each month — by your gross margin.

Some LTV:CAC ratios skip this step for simplicity’s sake, but we advise against it. LTV that’s based on total revenue instead of gross contribution per customer will make your LTV:CAC ratio seem higher than it truly is.

Step 4: find your churn rate

The tools you use to manage your subscriptions might calculate your monthly churn rate, but if they don’t, it’s easy to find. Count the number of subscribers you lost in a month and divide that number by your customer count from the start of the month.

Step 5: calculate your LTV

Now you know your average monthly profit per customer and the likelihood that customer will cancel their subscription. Divide the former by the latter, and you’ll identify your LTV.

This formula may look different than what you’re used to seeing for LTV (often expressed as ARPC x average subscription length), but mathematically, it’s very similar. You already know gross contribution per customer and ARPC are closely related — one just factors in the costs of your products and shipping.

Churn rate and average subscription length are also related. A customer’s expected subscription lifetime is equal to one divided by your churn rate. We divide gross contribution per customer by churn rate as a shortcut to find the gross contribution for the whole subscription lifespan.

With this number in hand, you’re finally in the home stretch!

Step 6: calculate your CAC

Finding your CAC is much easier than calculating an accurate LTV. Just divide one month’s sales and marketing spend by the number of new customers you acquired that month.

Subtract sales or marketing expenses that aren’t acquisition-focused (such as a campaign to upsell your current subscribers) if you have any. While having a slightly inflated CAC is less harmful than an inflated LTV, you want to keep both numbers as accurate as possible.

Step 7: divide your LTV by your CAC

Divide LTV by CAC to determine the return on investment of your marketing efforts. Write that number down, then read on to learn what it means for your subscription business.

what is a good LTV:CAC ratio?

LTV:CAC isn’t just for learning whether your company is on track to succeed. It can also help you chart the optimal path for growth. The best LTV:CAC ratios reflect a healthy balance between growth and profit. Subscription ecommerce companies should shoot for a ratio of around 2:1.

Here’s what different ratios mean for your subscription business:

an LTV:CAC ratio at or below 1:1

You’re losing money on each sale you make. You likely have a poor product-market fit or are advertising to the wrong audiences.

a ratio of around 2:1

You have a strong foundation. Make sure you continue to provide good customer service and give buyers what they value most, whether that’s convenience, monetary savings, or perks like access to new products.

a ratio of 3:1 or higher

You’re doing well at finding and retaining customers but could expand faster by increasing your marketing spend. Aim for demographics that are similar to your target market to broaden your customer base.

Once you’ve found your overall LTV:CAC ratio, break your audience down into cohorts and calculate the ratio for each demographic. Follow the LTV:CAC ratio benchmarks above to determine which consumer profiles you should focus your marketing and retention efforts on.

how to improve your LTV:CAC ratio

An LTV:CAC ratio below 2:1 means it's time to work on your business model to find a way to maintain profitability as you grow.

decrease CAC with better targeting

A high CAC typically means you’re paying to reach people who don’t care about your product or paying to advertise via channels that don’t reach your target audience.

It’s easy to get information about ad performance these days. Use this data to decrease acquisition costs by only supporting the marketing campaigns that have the highest conversion rates and/or reach your highest-paying demographics.

increase LTV by focusing on customer retention

Consumers want a convenient and customizable subscription experience — and if they don’t get it, they’ll leave. It’s easy to shift your focus away from customer experience if your business is struggling, but as a subscription merchant, that’s precisely the wrong thing to do.

You have a loyal audience of subscribers, and it would be a real shame to let them slip away. Use common tactics to reduce revenue churn and make sure your customers know about perks like coupons, free shipping, or flexible billing dates.

know what LTV:CAC can’t tell you

A low LTV:CAC ratio can tell you there’s a problem, but it won’t tell you what that problem is. You saw, during the calculation process, how many other metrics are used to calculate this one data point.

Use your performance on each of these KPIs to gain context about your LTV:CAC ratio and determine your next steps. A low LTV:CAC ratio caused by high customer churn rates will need to be addressed differently than one caused by excessive marketing and sales spend.

It’s never easy to make decisions that might affect the fate of your business, but you can move with more confidence when you understand the meaning of your metrics. Clarity on your LTV:CAC ratio puts you in the right position to chart a path toward sustainable growth.

-1.jpg?width=1600&height=900&name=63ffa560f4d632dc412ffc12_How%20To%20Calculate%20and%20Interpret%20Your%20LTVCAC%20Ratio%20(1)-1.jpg)