Ecommerce Fraud Protection Software for Merchants: How Sticky.io + Kount Fights All 8 Fraud Types

Keep the spark alive among your subscription customers. Avoid these common missteps that make even the most loyal customers fall out of love.

Your business faces a new reality: According to Juniper Research, ecommerce fraud losses hit $44 billion in 2024 and will reach $107 billion by 2029 — but the real challenge isn't just the numbers, it's understanding who's committing fraud and how they're doing it.

Consider this scenario: You've invested heavily in fraud prevention, yet losses continue to mount. Not just from traditional criminals, but increasingly from your own customers. LexisNexis Risk Solutions reports that first-party fraud — where legitimate customers dispute valid charges or abuse return policies—has become the leading fraud type globally, representing 36% of all reported fraud. Meanwhile, merchants are rejecting billions in legitimate transactions annually while trying to stop actual fraud.

Welcome to the AI-powered fraud economy of 2025. Signicat's Identity Fraud Report documents that while still representing a small portion of overall fraud, deepfake attacks increased 2,137% from a low baseline over three years. Synthetic documents now rival physical forgeries, and increasingly, established customers are discovering that initiating chargebacks can be easier than processing returns.

This is your practical guide for navigating a landscape where traditional defenses struggle against AI-generated attacks, where false declines can cost more than actual fraud, and where the solution requires rethinking fraud mitigation strategies.

The Rising Threat: Understanding Ecommerce Fraud in 2025

The data paints a clear picture of transformation. Juniper Research calculates that merchants' losses to online payment fraud will exceed $206 billion cumulatively between 2021 and 2025, with projections reaching $107 billion annually by 2029. What many merchants overlook: the acceleration is being driven by AI tools that make sophisticated fraud techniques accessible to more criminals.

The digital commerce landscape continues expanding rapidly, creating attractive targets for fraudsters. Recent industry analysis found that 48% of merchants now face refund and policy abuse as their primary fraud type—not stolen cards or identity theft, but customers exploiting system vulnerabilities.

Chargebacks911 research reveals that every dollar of fraud now costs US merchants $4.61 in 2025, up 37% from 2020. This multiplier effect includes investigation costs, chargeback fees, replacement orders, and critically—lost customer lifetime value from false declines.

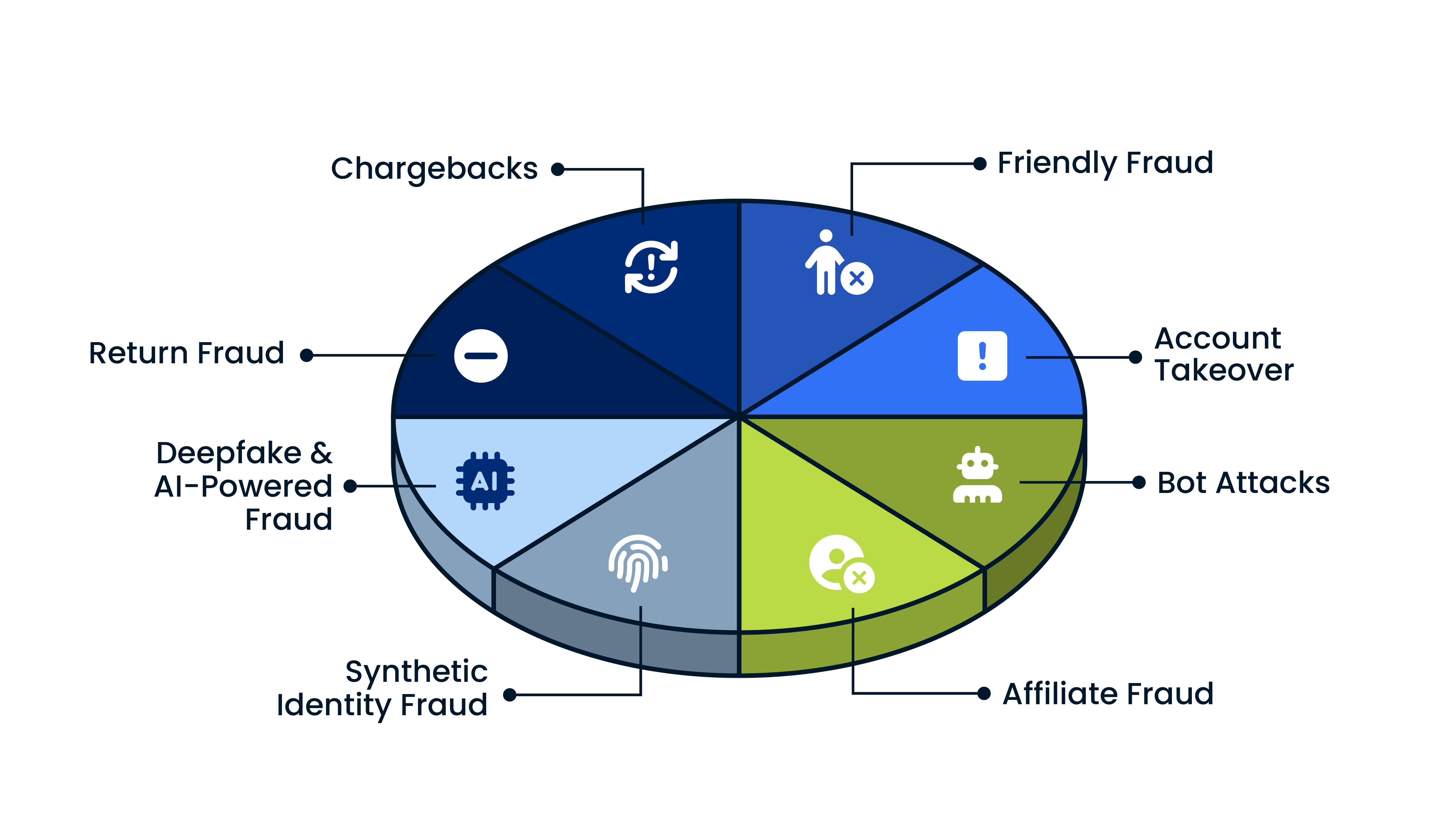

The 8 Critical Fraud Types Reshaping Your Business

1. Chargebacks: The Growing Profit Challenge

What is chargeback fraud?

Chargeback fraud occurs when a customer disputes a legitimate transaction with their bank or credit card company to receive a refund while keeping the purchased goods or services. The fraudster initiates a chargeback claiming the transaction was unauthorized, the item never arrived, or the product was defective — despite having received and kept the goods. This type of fraud costs merchants twice: they lose both the product and the payment, plus face additional chargeback fees ranging from $20-100 per dispute.

Chargebacks911 data shows significant increases in chargeback volume in recent years, with some sectors experiencing triple-digit growth. More concerning: their research indicates that 72% of cardholders now consider disputes a valid alternative to merchant refunds. They're not viewing this as fraud—they're using what they perceive as a feature of the payment system.

Key warning signs merchants often overlook:

- Customers ordering significantly above your average order value

- New email accounts created just before purchase

- IP addresses from data centers rather than residential connections

- Shipping addresses that don't match billing—particularly when combined with other risk factors

The true cost compounds quickly. Industry analysis shows that chargebacks create cascading financial impacts when factoring in fees, operational costs, and lost merchandise. Chargebacks911 forecasts global chargeback volume will reach 337 million disputes by 2026, representing continued growth from current levels.

-1.jpg)

Stay Ahead of Visa’s New VAMP Rules

Visa recently launched its Acquirer Monitoring Program (VAMP), a new system that tracks both fraud alerts and disputes under a single score. If your ratios climb too high, Visa can issue fines or even restrict your ability to process payments.

Because chargebacks and fraud now count toward the same compliance threshold, businesses need a proactive approach to fraud prevention and customer communication.

Learn more in our breakdown: VAMP Explained in Plain English for Merchants

2. Friendly Fraud: When Customers Become the Threat

What Is Friendly Fraud?

Friendly fraud happens when legitimate customers make purchases using their own payment credentials but later dispute the charges, claiming they didn't authorize the transaction or never received the items.

Common scenarios include buyers' remorse, forgotten subscriptions, or family members making purchases without the cardholder's knowledge, though increasingly it involves deliberate deception

Analysis from Chargebacks911 indicates friendly fraud accounts for 40-80% of all fraud losses, depending on the industry. These aren't career criminals—they're regular customers who've discovered they can obtain free products by claiming non-receipt or disputing legitimate charges.

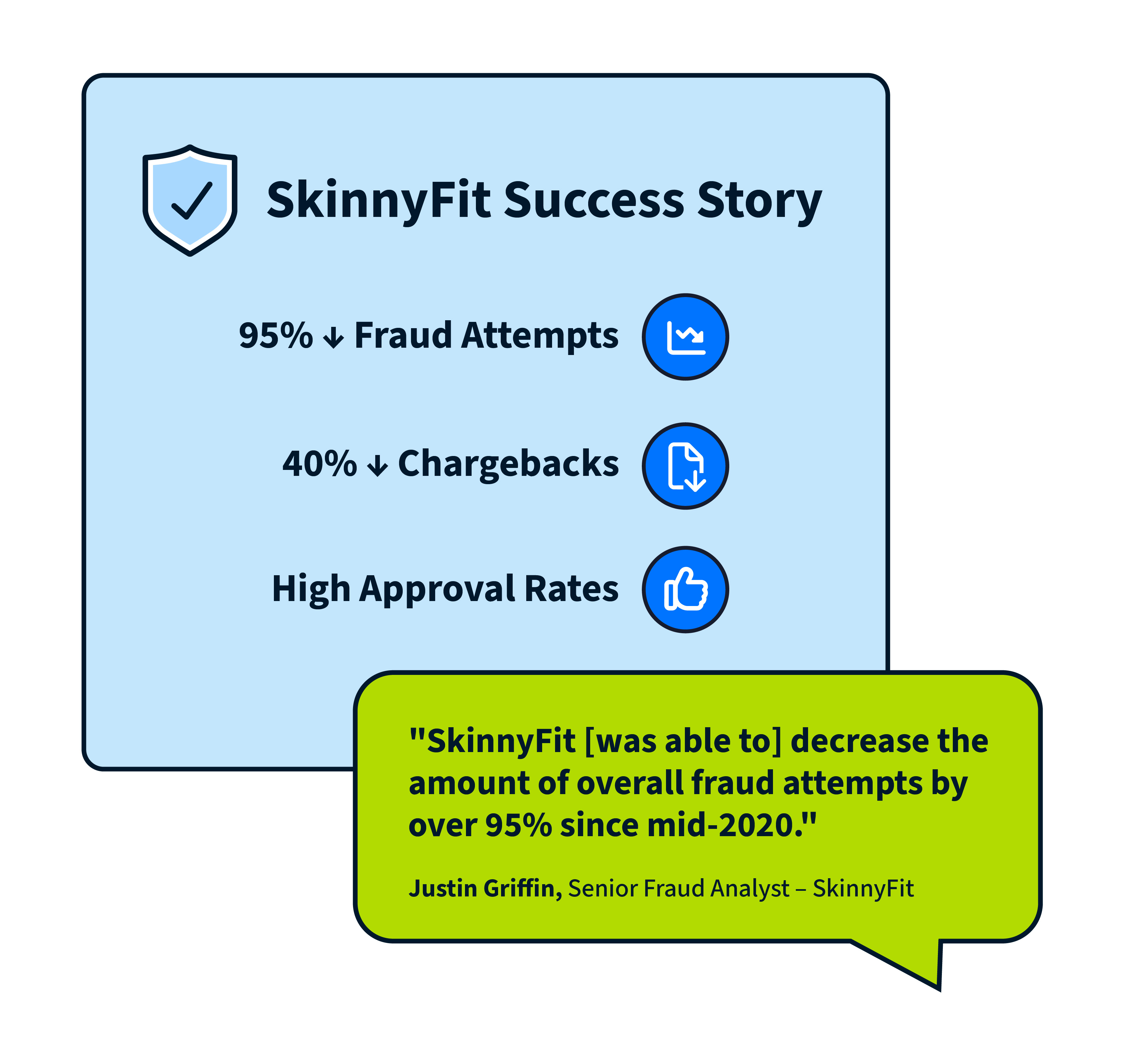

Justin Griffin, Senior Fraud Analyst for wellness brand SkinnyFit, whose team helped "SkinnyFit decrease the amount of overall fraud attempts by over 95% since mid-2020," explained in a past article:

"I think friendly fraud is one of the most challenging aspects of chargebacks because understanding the difference between malicious fraud and friendly fraud is crucial for prevention."

Critical questions for merchants:

- Is your refund policy driving customers to chargebacks as an easier alternative?

- Do you offer accessible customer support across multiple channels?

- Which marketing channels correlate with higher friendly fraud rates?

3. Account Takeover: The $13 Billion Challenge

What is Account Takeover Fraud?

Account takeover (ATO) fraud occurs when criminals gain unauthorized access to a legitimate user's account through stolen credentials, phishing, or data breaches. Once inside, fraudsters change account details, make unauthorized purchases, drain stored value, or steal sensitive personal information.

According to Sift's Q3 2024 Digital Trust Index, ATO attacks increased 24% year-over-year in 2024, following a staggering 354% increase in 2023, with criminals using sophisticated techniques like credential stuffing, session hijacking, and AI-powered social engineering to bypass security measures.

Research from AARP and Javelin Strategy found account takeover fraud resulted in $13 billion in losses in 2023. Industry research from Abnormal Security shows 83% of organizations experienced at least one ATO incident.

For businesses, the impact is severe: Alloy's 2024 State of Fraud Benchmark Report reveals that 57% of financial services organizations report losing over $500,000 in direct fraud losses annually, with over one-quarter losing more than $1 million. When factoring in breach remediation costs, IBM Security's 2024 Cost of a Data Breach Report shows the average total impact of a data breach reaches $4.4 million per organization — and reputational damage often exceeds even these financial impacts.

Modern ATO goes beyond stolen passwords. Criminals leverage AI to analyze social media profiles, crafting perfect security question answers and bypassing traditional verification. They demonstrate patience, often waiting months after compromise before striking during peak seasons when detection systems are overwhelmed.

4. Bot Attacks: Automated Threats at Scale

What are bot attacks?

Bot attacks deploy automated software programs to execute fraudulent activities at scale, including testing stolen credit card numbers, creating fake accounts, scraping pricing data, or overwhelming systems with traffic.

These bots can attempt thousands of transactions per second, identify valid payment credentials through small test purchases, and systematically exploit vulnerabilities in checkout processes. Retailers lose an estimated $100 billion annually to bot-driven fraud, with attacks becoming increasingly sophisticated through AI and machine learning capabilities.

F5 Labs reports that 10.2% of all HTTP requests come from bots, with 4.8% being unwanted.

Technical indicators of bot activity:

- Click patterns occurring at precise millisecond intervals

- Mouse movements following mathematical rather than natural patterns

- Multiple purchases using different cards but identical behavioral signatures

- Traffic spikes correlating with product announcements on reseller forums

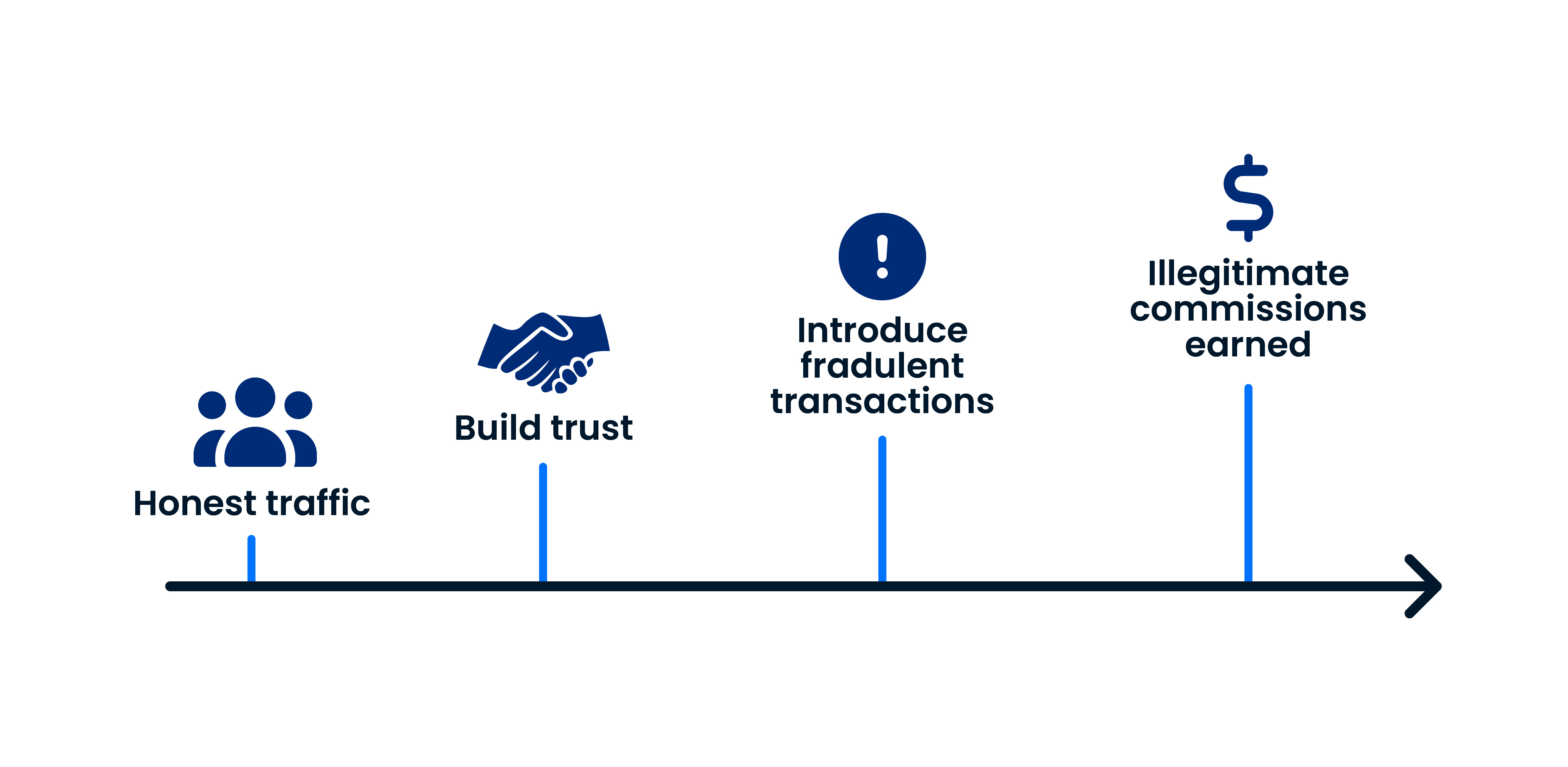

5. Affiliate Fraud: When Partners Become Problems

What Is Affiliate Fraud?

Affiliate fraud occurs when dishonest affiliates manipulate tracking systems to earn commissions they haven't legitimately earned. These bad actors use tactics like cookie stuffing (forcing affiliate cookies onto users' browsers without their knowledge), click fraud (using bots or click farms to generate fake traffic), or transaction fraud (creating fake sales using stolen credit cards).

The most sophisticated schemes involve affiliates who initially send quality traffic to build trust, then gradually introduce fraudulent transactions once they've established higher commission rates or preferred status.

Impact IQ research indicates that affiliate fraud costs advertisers up to $1.4 billion annually, with some merchants experiencing fraud rates as high as 20% of their affiliate traffic. More concerning: many businesses don't discover fraudulent affiliates until months after the damage is done, often only when chargeback rates spike or payment processors flag unusual patterns.

Common affiliate fraud tactics merchants miss:

- Sudden traffic spikes from new geographic regions without corresponding marketing changes

- Abnormally high conversion rates compared to other traffic sources (often 3-5x higher)

- Clusters of transactions with similar characteristics but different payment methods

- Affiliates whose customers have significantly higher return or chargeback rates

- Traffic that bypasses normal user journeys and lands directly on checkout pages

The challenge compounds because fraudulent affiliates often operate networks, using multiple accounts and sophisticated attribution manipulation to maximize illegitimate commissions. They exploit attribution windows, create fake social proof, and even hijack legitimate customer journeys at the last moment to claim credit for organic sales.

Taking Control with Sticky.io

Here's where Sticky.io's CRM platform becomes your secret weapon against affiliate fraud. With just a few clicks, you can instantly shut off suspicious affiliate traffic, protecting your revenue while you investigate.

The Sticky.io platform lets you track affiliate performance in real-time, flag unusual patterns automatically, and terminate fraudulent partnerships before they damage your bottom line. No complex integrations, no waiting for development resources — just immediate control when you need it most.

See how Sticky CRM helps merchants eliminate affiliate fraud while scaling legitimate partnerships.

6. Synthetic Identity Fraud: The Sophisticated Threat

What is synthetic identity fraud?

Synthetic identity fraud involves creating fictitious identities by combining real information (often stolen Social Security numbers from children or deceased individuals) with fabricated details like names, addresses, and birth dates. Fraudsters patiently build credit histories for these fake personas over months or years, maintaining good payment records before eventually "busting out" — maxing out credit lines with no intention to repay.

TransUnion research documents dramatic growth in synthetic identity fraud, with the 2024 State of Omnichannel Fraud Report showing synthetic identity fraud was suspected in 6.1% of all risky transactions in 2023, making it the fastest-growing type of digital fraud.

Unlike traditional identity theft, criminals combine real and fake information to create entirely new identities, nurturing them over years before exploitation. The Federal Reserve's Synthetic Identity Fraud Mitigation Toolkit defines this method as "identity compilation"—combining real and fake personally identifiable information to form a new identity. Also known as "Frankenstein fraud" in the industry, these schemes use stolen Social Security numbers—often from children who are particularly vulnerable targets. The Social Security Administration's Office of Inspector General revealed in 2023 congressional testimony that $1 billion in wages were fraudulently reported using 36,546 children's SSNs over three years, including 365 deceased children. Javelin Strategy & Research's 2022 study found that 915,000 children were victims of identity fraud that year alone.

The Nurturing Process

These synthetic identities often maintain better credit scores than legitimate customers. LexisNexis research found that over 50% of synthetic identities maintain credit scores above 650, with 85% evading traditional fraud detection systems. They establish trust through small purchases and timely payments over 6 months to 2+ years, gradually increasing credit limits from initial amounts of $500-$2,000 to $15,000 or more per account before maximizing credit lines and disappearing.

The Federal Reserve's analysis reveals that 70% of suspected synthetic identity accounts exhibit normal consumer payment patterns during the nurturing phase, according to TransUnion data cited in the Fed's October 2019 white paper. Fraudsters create comprehensive digital footprints including social media profiles, phone numbers, email accounts, and even library cards to support the synthetic identity's legitimacy, as documented by industry research.

Industry Impact

The auto lending industry alone has reported staggering losses. Point Predictive's 2024 analysis of 180 million loan applications found $7.9 billion in auto lending fraud exposure, with synthetic identity fraud surging 98% year-over-year and representing the fastest-growing threat vector.

The analysis, drawn from Point Predictive's Auto Fraud Manager consortium database covering over $3 trillion in scored applications, found that income and employment misrepresentation, synthetic identities, and credit washing account for nearly 75% of all auto lending fraud risks.

Regulatory Response

The Federal Reserve System has published comprehensive white papers and a Synthetic Identity Fraud Mitigation Toolkit to help financial institutions combat this threat. FinCEN's January 2024 analysis of 3.8 million Suspicious Activity Reports found $212 billion in identity-related suspicious activity for 2021, with synthetic identity fraud comprising a significant portion.

Growing Sophistication

The sophistication of these schemes continues to evolve. Fraudsters execute "double bust-outs" using fake checks to pay off balances before maxing out credit again, or file false identity theft claims to remove charges and repeat the fraud cycle. Average losses per synthetic identity reach $15,000, with some cases exceeding $100,000 across multiple institutions.

McKinsey estimates that 10-15% of charge-offs in typical unsecured lending portfolios stem from synthetic fraud, the Deloitte Center for Financial Services projects losses could reach $23 billion by 2030, cementing synthetic identity fraud's position as the fastest-growing financial crime threatening modern commerce.

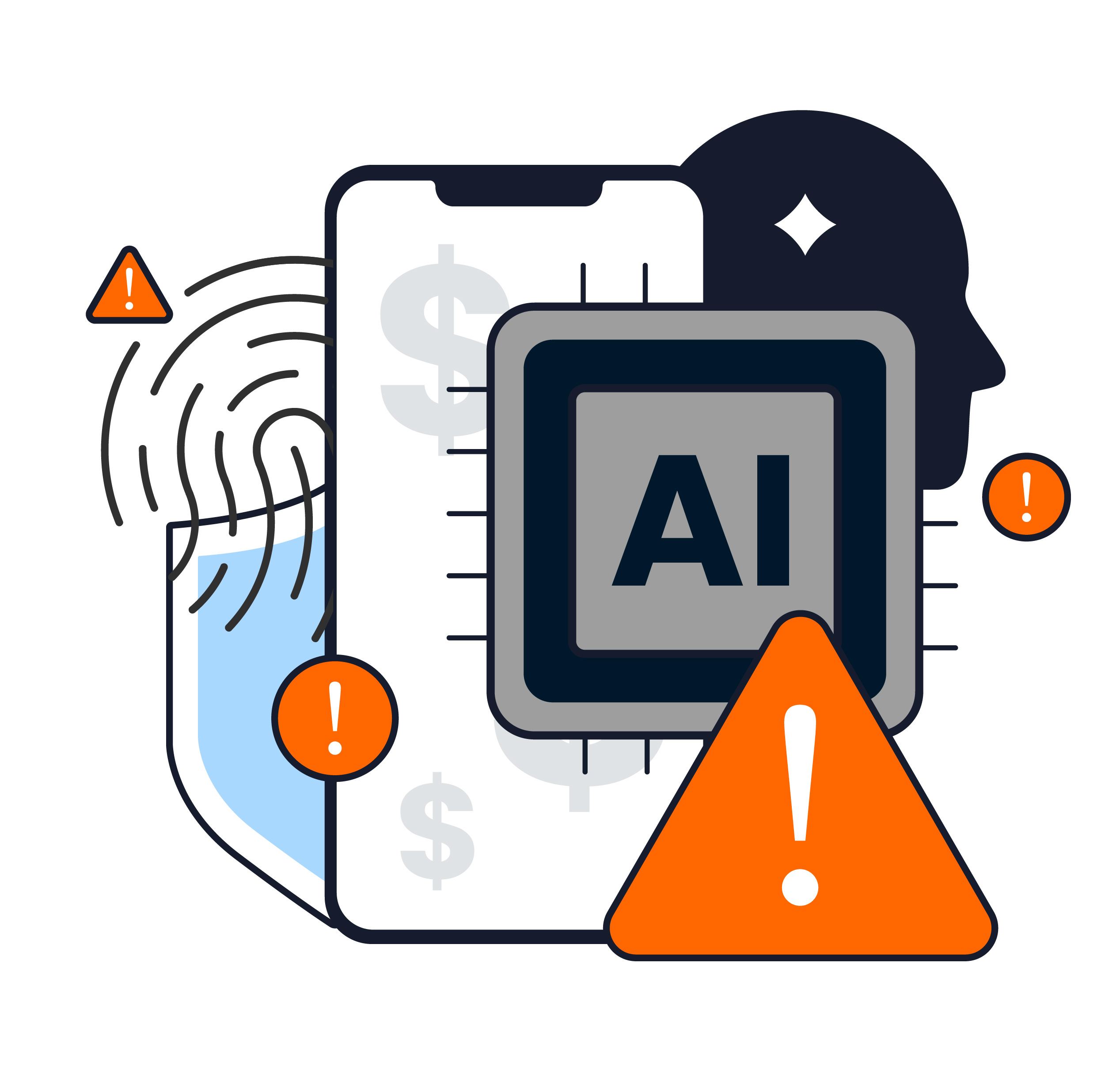

7. Deepfake and AI-Powered Fraud: Emerging Threats

What is deepfake & AI powered fraud?

Deepfake and AI-powered fraud uses artificial intelligence to create convincing fake audio, video, or images that impersonate real individuals for fraudulent purposes. Criminals use voice cloning to authorize wire transfers over the phone, create fake video calls to pass identity verification, or generate synthetic documents that appear legitimate.

With generative AI tools becoming widely accessible, incidents increased 3,000% in 2024, enabling everything from CEO impersonation scams to bypassing biometric authentication systems.

Signicat's Identity Fraud Report documents a 2,137% increase in deepfake fraud over three years, though from a relatively small baseline. A widely reported incident in Hong Kong saw criminals steal $25 million using deepfake video technology. The greater concern is the democratization of these tools.

For minimal investment, fraudsters can now:

- Generate convincing phishing emails in any language

- Create synthetic voice recordings from brief audio samples

- Produce fake identification documents

- Build complete synthetic identities with AI-generated imagery

8. Return Fraud: The $103 Billion Issue

What is return fraud?

Return fraud exploits retail return policies through various schemes: returning shoplifted merchandise for cash, using counterfeit receipts, returning used or damaged items as new, or "wardrobing" — buying items for one-time use then returning them.

Fraudsters also engage in receipt fraud, finding or stealing receipts to return matching items taken from store shelves, or exploit lenient online return policies by claiming items never arrived.

Appriss Retail and Deloitte report return fraud reached $103 billion in 2024, representing 15.14% of all returns. Consumer research indicates 69% of shoppers admit to "wardrobing" — purchasing items with the intention to use and return them.

Generational patterns in return behavior:

- NRF research shows 51% of Gen Z engage in "bracketing" (buying multiple sizes/colors planning to keep only one)

- Millennials are quick to share negative experiences on social media

- Industry studies show 76% of consumers consider free returns essential when choosing retailers

The True Cost: Beyond Lost Revenue

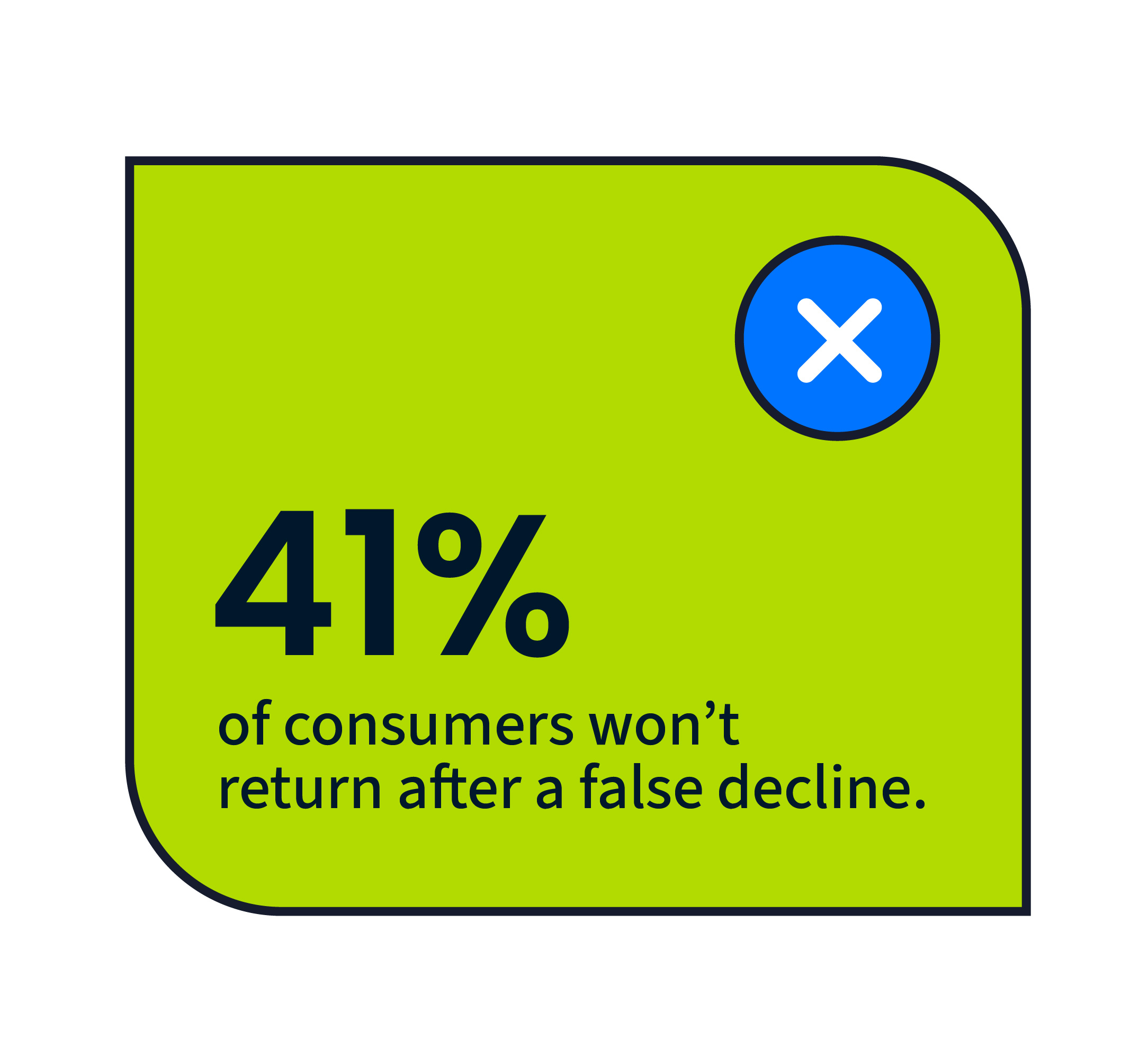

The False Decline Problem

ClearSale and Aite Group research indicates false declines cost the industry $443 billion annually — nearly ten times the actual fraud losses. This means merchants lose significantly more to false declines than to actual fraud itself.

Impact on customer lifetime value:

- Gen Z customers can represent significant lifetime value

- ClearSale research shows 41% of consumers won't return after a false decline, with the impact particularly severe among younger shoppers — 40% of Gen Z consumers boycott brands after false declines and 35% share their negative experience on social media, rapidly damaging brand reputation.

- Javelin Strategy research reveals 39% of American consumers abandon their card after experiencing a false decline

- Many customers immediately abandon carts and shop elsewhere after declines

The Multiplier Effect

Chargebacks911 calculates the true cost multiplier has reached 4.61x in 2025. This encompasses:

Direct costs:

- Lost merchandise and shipping

- Chargeback fees and penalties

- Payment processing fees on fraudulent transactions

Hidden costs:

- Manual review labor

- Customer service time

- Technology investments

- Compliance costs

Opportunity costs:

- Lost customer lifetime value

- Reputational damage

- Market share erosion

- Reduced marketing efficiency

-1.jpg)

The Sticky.io + Kount Partnership: Your Fraud Mitigation Solution

How Sticky.io Transforms Fraud Mitigation Through Strategic Integration

Sticky.io has built a comprehensive fraud mitigation ecosystem through strategic partnership with Kount, an Equifax company. Rather than developing native fraud prevention, we leverage industry-leading fraud detection technology seamlessly within your existing workflow.

Jamie Kinshella, Partner Business Manager at Kount, notes: "We've built a truly strategic partnership with Sticky.io through cross-functional collaboration with a common goal of helping merchants securely scale their businesses with unmatched customer experience."

Kount's Technology: Data-Driven Defense

Through our Kount integration, Sticky.io merchants access:

Advanced Machine Learning:

- Supervised and unsupervised learning working in tandem

- Real-time analysis of 500+ transaction attributes

- Access to billions of data points from Kount's global network

- Identity Trust Global Network linking fraud signals across thousands of merchants

Demonstrated Performance:

- Up to 95% fraud detection accuracy compared to 60-70% for rules-based systems

- 60% improvement in fraud detection with reduced false positives

- Up to 75% reduction in chargebacks

- 60-80% reduction in manual review requirements

Integration Mechanics: Seamless Protection

1. Real-Time Analysis When customers complete purchases through Sticky.io:

- Kount collects comprehensive data points

- Machine learning analyzes historical and current risk indicators

- Assessment occurs in milliseconds without impacting user experience

2. Intelligent Decisioning

- Approved transactions proceed to payment processing

- High-risk orders are blocked, protecting your merchant account

- Flagged transactions receive detailed risk analysis for review

- Custom rules align with your specific business requirements

3. Continuous Improvement

- Every transaction enhances system accuracy

- New fraud patterns are identified automatically

- Business-specific patterns train the AI for precision

Comprehensive Protection Features

Device Fingerprinting and Behavioral Analytics

- Multi-layer device fingerprinting

- Analysis of 200+ user interaction patterns

- IP proxy and geo-location verification

- Device Data Collector integration

Custom Rule Management

- Business-specific rule creation

- SKU and IP address flagging

- VIP customer lists for friction reduction

- Category and campaign-specific thresholds

Network Intelligence

- Link analysis across shared data points

- Fraud ring identification

- Access to Kount's Identity Trust Global Network

- Collective intelligence from thousands of merchants

Building Your Defense Strategy: The 2025 Playbook

Layer 1: Risk Scoring Configuration

Configure your Sticky.io + Kount integration to evaluate:

- Customer history and loyalty metrics

- Transaction context and behavioral patterns

- Device fingerprinting and location data

- Real-time threat intelligence

Implement dynamic thresholds by category and segment rather than blanket policies.

Layer 2: Authentication Strategy

Sticky.io's 3D Verify implementation:

- Shifts liability to issuing banks

- Applies stepped authentication based on risk scores

- Maintains frictionless checkout for low-risk customers

- Provides strong authentication for high-risk transactions

Layer 3: Chargeback Management

Prevention Tools:

- Real-time alert systems

- 24-72 hour resolution windows

- Automated response capabilities

Recovery Services:

- Sticky.io Representments automation

- Professional dispute management

- Revenue recovery without manual effort

Layer 4: Ecosystem Partnerships

Beyond Kount, Sticky.io partners include:

- Verifi and Ethoca: Pre-dispute resolution

- Only Transaction Select: Customer screening without friction

- 400+ integrations: Comprehensive fraud mitigation ecosystem

Real-World Success: SkinnyFit Achieves Over 95% Fraud Reduction

Justin Griffin, Senior Fraud Analyst at SkinnyFit, shared tactics and strategies that helped "SkinnyFit decrease the amount of overall fraud attempts by over 95% since mid-2020."

This wellness brand and mutual client of Sticky.io and Kount achieved:

- Over 95% decrease in fraud attempts since mid-2020

- 40% reduction in chargebacks in six months

- Maintained high approval rates for legitimate customers

"Kount offered us something other companies couldn't: the ability to write our own custom rules that apply to our unique situation," Griffin explains. "I didn't have to buy someone else's pre-packaged sets."

Key Insights for Modern Merchants

Collaboration Beats Isolation

No single merchant can match criminal networks' collective intelligence. Sticky.io's partnership with Kount provides access to insights from thousands of merchants and billions of transactions, plus the advanced capabilities of a dedicated security platform backed by Equifax.

Balance Is Essential

With false declines costing $443 billion versus actual fraud losses, aggressive prevention can cost more than accepting manageable fraud levels. The goal is optimization — balancing loss prevention with customer experience.

Technology Arms Race

AI has democratized both attack and defense capabilities. While criminals use AI for sophisticated attacks, Kount's AI learns and adapts faster. Machine-speed attacks require machine-speed defense, which our integration provides.

Integration Quality Matters

Having fraud tools isn't sufficient — seamless integration is crucial. Sticky.io's deep integration with Kount ensures automatic data flow, instant decisions, and maintained control without added complexity.

Solutions Exist Today

Building fraud prevention from scratch is unnecessary. Sticky.io + Kount provides enterprise-grade fraud mitigation already helping merchants process over $8 billion annually with confidence.

Transform Payment Friction Into Growth

The fraud landscape of 2025 represents a fundamental shift in how commerce operates. When customers view chargebacks as service features rather than fraud; when AI makes sophisticated attacks accessible; when false declines cost ten times actual fraud — traditional approaches become counterproductive.

However, this crisis contains opportunity: merchants using Sticky.io's integrated fraud mitigation gain competitive advantage. While competitors struggle with multiplied fraud costs and high false positive rates, you can achieve up to 95% fraud detection with minimal impact on good customers. While others rely on outdated rules, you deploy adaptive AI that learns in real-time.

Success with Sticky.io + Kount requires three strategic shifts:

First, recognize that managed fraud mitigation outperforms DIY solutions. Let specialists handle complexity while you focus on growth.

Second, understand that integration beats isolation. Our Kount partnership provides collective intelligence no single merchant could achieve independently.

Third, embrace strategic AI deployment. You don't need to understand every algorithm—you need a platform that implements them effectively.

Successful merchants in 2025 won't be those preventing the most fraud — they'll be those optimizing total fraud cost, including false declines, customer experience, and lifetime value. They'll treat fraud mitigation as a competitive differentiator enabling growth while others retreat.

Ready to Transform Your Fraud Mitigation?

Sticky.io's partnership with Kount delivers comprehensive fraud mitigation that protects revenue without sacrificing customer experience. Our proven platform combines:

- Intelligent payment routing across 160+ gateways

- AI-powered fraud detection through Kount integration

- Automated chargeback prevention and recovery

- Customizable risk management aligned with your business

Join merchants processing over $8 billion annually who trust Sticky.io to turn payment friction into growth opportunity.

Schedule a Demo to see how Sticky.io + Kount can protect your revenue →

This analysis is based on 2024-2025 fraud data from leading research firms and industry reports. Sticky.io's fraud mitigation capabilities are delivered through strategic partnership with Kount, an Equifax company. All statistics are sourced from verified third-party research as cited.